US military and economic power projection just got real, causing Europe to suffer psychological dissonance. It will get worse. Meanwhile, the US Treasury and its advisors must get real about the $10 trillion of bond refinancing required this year. Yellen's parting gift to her successor, Scott Bessent, makes Rachel's black hole gifted by the Tories look more exaggerated than a line item on her CV. The Trump administration will look at ways of using other people's money. When they meet next week, Keir Starmer’s offer to Trump must include a sharp increase in defence spending and an order for a large tranche of long-dated US Treasuries. If this requires disposing of Reeves, then buckle up for Truss 2.0.

All politics is based on a mix of physical and abstract power. Physical force determined our early predecessors' hierarchies, making them indistinguishable from other animals in a cruel subsistence existence. Gradually, our power structures became abstracted. The evolution of Common Law, the Magna Carta, and the US Constitution were critical, unleashing humanity from the yoke of absolutist arbitrary power and physical force.

Parents will recognize that the threat of physical coercion often develops norms of an abstract power hierarchy in the home. Adolescence is frequently accompanied by the notion of equal householder rights among teenagers who don't see why they should go to bed, keep their rooms tidy or worse. These uprisings become more challenging in the case of parental separation when teenagers can fall under a new abstract power hierarchy that they reject.

This week, we returned from a trip to the home we share with my "adult" stepsons, who have gradually come to tolerate the notion of my bill-payer household authority. It dawned on me that Europe is experiencing a similar psychologically dissonant trauma to the one my stepsons have endured over the past decade or so as the new abstracted power hierarchy has become (begrudgingly) accepted.

The established post-WWII abstract power hierarchy under the UN (anyone heard from them lately?), NATO, etc., has been crumbling for many years. However, JD Vance's broadsides at this week's Paris AI Safety Summit and Munich Security Conference left his stunned audiences in little doubt that the West has a new American daddy. Furthermore, if there is any paternal love, it's tough love that requires greater resilience and independence for his protectorates. I understand why JDV's message was not universally welcomed; I have seen this before.

What Europeans make of these events critically depends on whether they see Trump primarily as the cause of the breakdown of the post-WWII order or one of its symptoms. Either way, the old certainties of agreed abstract international power are gone; we are in a new world of realism. As Keith Kellogg, Trump's frosty envoy for Ukraine (sorry couldn't resist it), confirmed when bluntly stating that European allies were excluded from peace talks, he is from "the school of realism, and that is not going to happen." This theoretical framework views world politics as a competitive struggle between self-interested states vying for power within an anarchic global system.

As Professor John Mearsheimer of Chicago and the pre-eminent advocate of the Realist School, albeit sceptical of Trump's peace plans for Ukraine, has said,

The sad fact is that international politics has always been a ruthless and dangerous business and will likely remain that way. In the anarchic world of international politics, it is better to be Godzilla than Bambi.

Amid last week's JD Vance bombshells, the UK maintained a low profile, conspicuously not signing Macron's AI safety communique nor following the German attack on Vance's speech. As Keir Starmer prepares for his trip to Washington this week, one hopes that he will not only be adequately briefed on the ideas of Professor Mearsheimer but also those of Trump's nominee for Chair of the Council of Economic Advisers, Stephen Miran, who sees trade policy directly tied to the US's national security interests.

Helpfully, a paper written by Miran in November circulated on X this week, titled A User's Guide to Restructuring the Global Trading System. The paper argues that the current global trading system is unfair to the United States and that the country should use its economic power to force other countries to change their trade practices. It proposes several specific actions that the United States could take, such as imposing tariffs on imports from countries that do not comply with its demands.

Miran highlights the US dollar's Triffin Dilemma, which has left it with an uncompetitive currency at the expense of its trading partners for whom it provides military protection. The bill for this inconvenience has just come due, and the US expects its trading partners to pick up the tab.

Miran says,

If you have no supply chains to produce weapons and defence systems, you have no national security. If you don't have steel, you don't have a country.

Miran's view contrasts starkly with the infamous comment by George HW Bush's chief economic advisor, Michael Boskin, who in 1992 said that,

Whether a country makes potato chips or computer chips doesn't make any difference!

Treasury Secretary Bessent highlighted an example of the realist approach this week, in Europe attempting to extract exclusive Ukrainian mineral rights in exchange for military air cover.

One wonders what goodies Sir Keir can offer Donald this week in exchange for looking after the UK.

However, as Musk and DOGE continue to absorb the headlines in US domestic policy, Bessent, with the advice of Miran, must tackle the reality of the US debt pile and broader US balance sheet issues of fiscal and monetary policy.

Here, Miran offers another recent study published jointly with Nouriel Roubini last year entitled, The Tug of War Over Monetary Policy, highlighting the policy clash between the Fed and the US Treasury, which they call Active Treasury Issuance (ATI), or stealth QE.

The paper critiques former Treasury Secretary Yellen's policy of issuing a larger proportion of T-Bills (notes of a year or less in duration) instead of the more usual quota of longer-maturity (2-30 yr) Treasury bonds. Miran and Roubini regard ATI as quantitative easing delivered by a politically motivated Treasury.

The authors contend that,

Contrary to the Fed's insistence that monetary conditions are restrictive, they are not, and the Treasury's issuance policies help explain the persistence of inflation and strong economic growth. Heavily relying on bill funding sets up an unattractive problem for whoever is in charge at 1500 Pennsylvania after the election: the need to term out all those bills into duration-bearing coupon securities. We expect the Treasury to have $1 trillion of excess bills by early next year.

The market only has a finite capacity to assume interest rate risk, and pushing out duration will negatively impact risk asset pricing. But it gets worse.

This ATI stimulus, intended to coincide with the election, coincides with other chickens due home to roost. The reinstatement of the Federal debt ceiling is moving into full view.

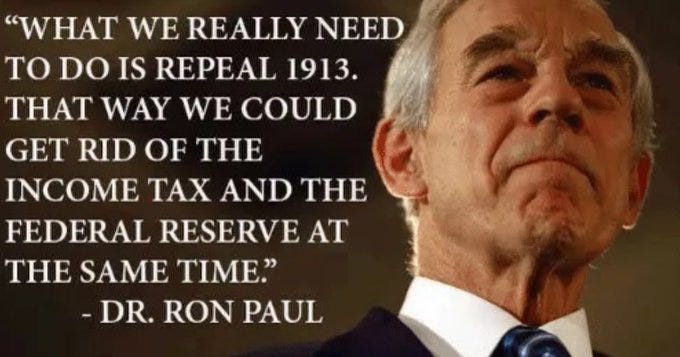

Furthermore, Treasury Secretary Yellen has exhausted the post-COVID one-time-only liquidity pools. She tapped out the Treasury General Account to extend the Federal Debt Ceiling for another 12 months and her heavy bill issuance has hoovered up several trillions of Reverse Repo Reserves. The new administration inherits emergency funds that are as depleted of liquidity as the Strategic Petroleum Reserve is of hydrocarbons. Further, we await Trump's nomination as Jay Pow’s successor at the Fed. Musk has already suggested Ron Paul as the fox in the hen house.

Roubini and Miran highlight the problems of abstract money issuance under an ideologically inclined MMT academic, Yellen, versus the hard money realism of the incoming regime under a battle-hardened billionaire capitalist, Scott Bessent. In addition to trying to extract mineral rights from Ukraine, Bessant has spoken of the potential to monetise the asset side of the US's balance sheet. In a comment that got gold bugs everywhere excited, he said,

We're going to monetize the asset side of the US balance sheet for the American people. We're going to put the assets to work, and I think it's going to be very exciting.

Economic and monetary realism suggests that marking to market the US's gold reserves from their historic $42 oz might be an obvious place to start in this balance sheet restructuring. However, other than mentioning the potential for this approach to lower the yield curve and reduce borrowing costs like mortgage rates, he didn't speculate further.

Bessent needs to refinance $10tn of maturing bonds this year, with approximately 70% due in H1. Miran provides him with the intellectual air cover to demand assistance from the US's trading partners. If Sir Keir Starmer wants to please his new daddy next week in DC, he needs to make specific plans to significantly increase the UK’s defence budget and place a large order for long-dated US Treasuries. If the price he pays for this is the loss of his Chancellor and her difficult fiscal constraints, then buckle up for Truss 2.0.