Investing Like Lazarus Lake

After last week’s piece on growth stock investing with Alex Sweet of Sweet Stocks, I published my podcast interview with him and Adam Rackley. Here's another chance for those who didn’t listen to it last week.

I also wrote a piece for Dowgate Wealth, essentially a shorter variant of last week’s post:

The Curious Investor - 'Beating the Fade - Simple but Not Easy'

One of the topics of conversation with Alex was his obsession with ultrarunning, his love for the Barkley Marathons, and his respect for founder Gary Cantrelle, AKA Lazarus Lake.

Here is a 22-minute documentary describing the extraordinary human endeavour and quirkiness that makes this event special.

As Laz says, you haven’t tested your limits until you try to do something you can’t do. This highlights the exceptional combination of idiosyncrasy and good fortune required to finish this event.

In the 38 years this event has been run, only 20 people have finished the course, a more than 99% failure rate. When a failed, exhausted, but elated athlete walks back via Quitters Road, Laz tells him I only wished you could have suffered longer.

Celebrating the fewer than 2% of runners that have completed this event is a bit like celebrating the investment results of spectacular investors like Nick Sleep of the Nomad Investment Partnership, which was based essentially on a portfolio of just three stocks.

Laz again,

You have to do everything right and not make a mistake, but it can be done.

However, the self-actualisation and fulfilment runners seek by lining up for the 100-mile five-loop wilderness conditions you could imagine being better served by doing the local Park Run.

Similarly, individual investors might be best served by not trying to replicate Nick Sleep's investment philosophy. After all, was Sleep good or lucky? We don’t know and can’t learn from all the non-finishers in the investment ultra from which Sleep emerged victorious.

As Morgan Housel told us, the mindset for creating wealth differs from that for retaining wealth. The former requires focus and specialisation, and the latter frugality and paranoia.

But none of this means we can’t or shouldn’t celebrate those who assume such incredible odds against failure but still win.

As Laz says,

The runners have made it what it is. Every time someone finishes, I feel like I am elevated by being there. To have seen something that difficult achieved.

The Pub Ultra

Tim Martin of JD Wetherspoon is a UK entrepreneur who has created wealth through laser focus and specialisation. At about the same time that Lazarus Lake organised the first Barkley Marathons Event, Tim Martin opened his first pub. In last week’s full-year results release, Martin gave vent to some of his usually forthright views about the trading environment in which his business has to operate. His usual verbal assault victims include government policy to lockdowns, the reported attack on pub opening hours, the size of the pint serving glass, unequal tax regimes enjoyed by the on-trade and off-trade and the useless box-ticking exercise of corporate governance “best practice.”

But just like Lake’s competitors trailing around the Appalachians of Tennessee, Martin’s journey against the harsh reality of growing a successful pub chain is nothing if not a battle against a hostile environment. Over the last six years, this environment has seen more than 3,000 pubs close their doors, the equivalent of nearly four Wetherspoons’ estates.

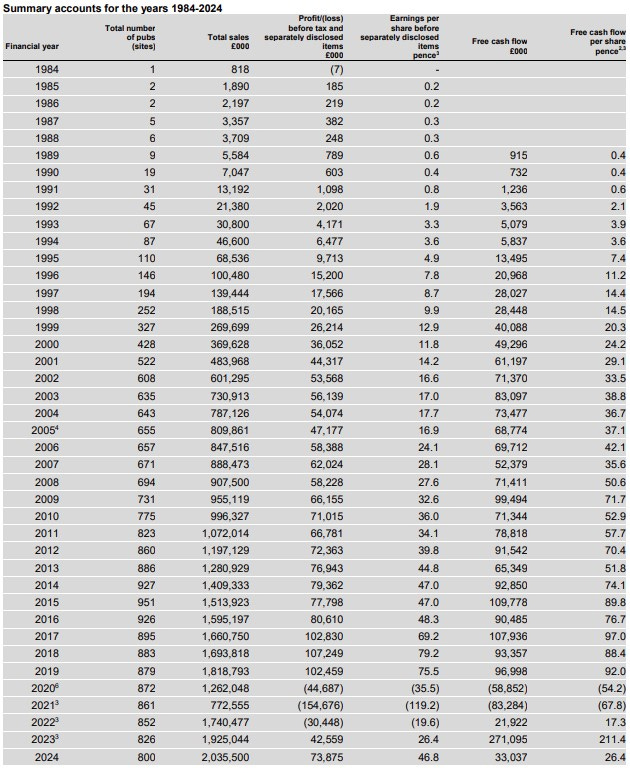

In the spirit of Alex Sweet’s assertion that the best place to look for anomalous growth potential is those companies that have exhibited these traits over past years and decades, Wetherspoon published its summary financial results for the past forty years:

I suspect Laz in Tennessee might approve of Tim Martin and Spoons enduring success.

Market Call

In this week’s chat, Gareth and I focus on Asia. The "Beijing Bazooka" launched Chinese equities skywards, taking the prevailing view of Chinese equities from uninvestable to FOMO in a week. Meanwhile, Japan still poses a risk to global markets. Ironically, current tensions in the Middle East might be helping markets ignore Japan for a while longer. However, in Europe, inflation has fallen fast, raising concerns of a slowing economic outlook and a deflationary debt spiral, with concern focusing on spiking French debt and greater than normal political division.

Overall, the UK plc report card is looking quite positive. In addition to a more buoyant housing market in the UK, we have a suddenly active set of equity markets, with plenty of deals, fundraisings, and another IPO all on the radar. Hopefully, the Budget won't deliver any negative surprises that haven’t been flagged in advance. The UK seems to be Keeping Calm and Carrying On.

After recording this episode, we got some hot US job numbers, which have added some "extra spice" to markets trying desperately to understand the future interest rate path. Given its notorious unpredictability and high historical revisions, it is probably not worth getting too hung up on one month’s jobs data. However, it would appear that short-dated bond yields have fallen too far too soon.

The Austrian View

In his column this week, the always original Matthew Syed discussed modern society's impatience and how we, the West, came to discover and then lose the co-evolutionary success factors of mutual trust and patience required to build wealth and capital.

Syed inadvertently uncovered the truths we have “lost” from the great Austrian economists.

Sayed said,

[That] something happened in the 1970s to reverse the patience of the Western world. You can glimpse this in a seven-word slogan coined in 1972 for a new credit card: “Access takes the waiting out of wanting!” The implication was clear: why wait? Spend now! Think about repayment later! I’m not suggesting our “flexible friends” were solely responsible for this shift (the dropping of the gold standard in 1971 may have played a part), but they reflected a new zeitgeist. Our sense of “long time” was fragmenting. We became a society ever more obsessed with me and now.

As Edward Chancellor pointed out, interest rates are the Price of Time. They represent the revealed preferences investors and savers have for our value of time. A market-determined interest rate solves the question: Would you prefer £100 today or £110 next year?

A critical determination of this decision rests on the real, inflation-adjusted value of a £ in the future. If inflation makes the purchasing power of a £ less in the future, the rate I might seek to compensate for my deferred consumption today would be correspondingly higher.

Syed was right in suggesting that our greater impatience over the last 50 years has resulted from the debasement of our monetary system, which in turn resulted from removing the last linkage of the US$ to gold convertibility.

For more details, visit the brilliant website WTF Happened in 1971? https://lnkd.in/epKGaEYm

One consequence of an unshackled fiat monetary system is the perversion of our collective time preference. Centralised monetary policy sets artificially low rates. The Access credit card strapline, Taking the Waiting Out of Wanting, has become everyone's expectation, consumers and governments alike.

The Theory of Money and Credit by Ludwig Von Mises describes our current problems from the historical perspective of 1912. Reading it, like deferring consumption for consumers or adhering to the fiscal discipline of hard money for governments, is not easy. However, we are way past the point where the solutions to our fiscal and monetary problems are easy.

And Finally

Another dead Austrian with a moustache had a call with PM Starmer last week: