It is widely believed that the UK stock market is failing, and we must do something to revive it. But is it, and must we?

Sure, UK equities are under siege. But is this the fault of the listing venue or any of its participants? Here's the thing: Price mechanisms don’t operate in one-way traffic. And, for this reason, the secondary pricing of smaller UK equities ceased to function years ago.

However, this doesn’t mean that we must find scapegoats. Don’t tell policymakers, they can’t afford to hear it, but eventually, spontaneous order evolves, imbalances are corrected, and new versions of the future come to pass, undirected. This is precisely what is now happening as the UK smaller companies market is at last showing some hopeful vital signs.

In reality, UK small caps, which have consistently experienced net outflows for a decade, have been caught in an ultra-slow-motion price discovery process. So slow that it failed to operate for most observers, leaving a lower layer of the UK's stock market where Laurence Hulse of Onward Opportunities is looking for what he calls "gems among the rubble". Assets that have not been valued by informed real money for years, effectively forever.

Here he is this week, discussing one such gem, Alumasc, an unlikely global leader in drainage systems. Who would have guessed?

Strategic investors with global capital can currently acquire UK-listed companies, such as Alumasc, at a substantial premium and yet still generate a decent return. How can they do this? Because the only other consistent competitor for these buyers is share buybacks (which not all companies can offer; for Alumasc, there is an obstacle in the form of a legacy pension fund liability). As a result, high-quality UK-listed companies are becoming scarcer, particularly in the absence of initial public offerings (IPOs).

Having left UK assets stranded on the post-Brexit naughty step, global investors proceeded to accumulate over-large amounts of unhedged dollar assets, much of it passively. It was a very profitable trade; they never looked back at the UK (or other outposts of global value, such as Japan), why would they? Actively buying value assets? That was so last century. But like all good things, this trade has now played itself out, and global capital is back on manoeuvres looking for new homes.

With it, the period of neglect for UK equities is coming to an end. Indeed, the capitulation trade might have already marked a low point for UK small and mid-cap stocks, as foreign capital supplements stranded domestic investors on their value-laden life rafts. And UK assets are, at long last, starting to register healthier returns.

Accordingly, a few brave souls who have weathered the wilderness years are beginning to emerge into the sunshine, blinking in bemused surprise, their inner convictions reconfirmed. They dare to think that the war of attrition is over. They sense victory. They may be right.

This is Thomas Moore of Aberdeen Asset Management, formerly Abrdn, Aberdeen Standard Life and Standard Life Investments. With so many names over the door, he might understandably feel confused, but he must, at times, have also felt alone.

However, you couldn't meet a friendlier, more jovial chap than Thomas, despite enduring years of neglect, particularly in his chosen UK value and income strategy. He no doubt questioned his career choice, not to mention, at times, his own sanity.

Thomas manages the Aberdeen Equity Income Trust, which for most of the last decade has traded below its net asset value (NAV). For over ten years, the market appraised Thomas's dedication to his strategy as being worth less than zero. Yet, he carried on regardless, delivering income returns to his investors. His trust did what it said on the tin.

However, over the last couple of months, strange things have begun to happen. His flagship fund has consistently traded at a premium, allowing it to expand by issuing new shares —a vital sign, albeit in the early innings, that the UK stock market is slowly recovering after its extended period of neglect.

But hold on, before we get carried away, aren’t all manner of companies moving their listings to the US? The perilous state of the IPO market shows that the UK remains toxic.

In a Bloomberg opinion piece last week, London’s Incredible Shrinking Stock Market, Marc Rubenstein said with delicious irony that data provider LSEG should be a prime beneficiary of a NASDAQ listing. But wait, somewhere in the outer reaches of LSEG's portfolio, isn't it also the national listing venue for the UK? However much it might try to forget, LSEG got its name from somewhere. Delivering shareholder value by listing LSEG on NASDAQ would be, as they say these days, awkward.

But who on earth would choose to list their shares in London?

The last time the UK experienced an IPO boom was in 2021; it spawned a cohort of over-inflated failures, and the Financial Times documented how poorly they have performed in a piece titled "A Quarter of Top Companies Floated in 2021 Have Exited the Stock Market." Charles Hall of Peel Hunt indicated that he thought the dearth of new issues was partly because they were all prematurely floated (at exorbitant values) in 2021. There are none left; they were all flogged off years ago.

The last job-lot was such a disaster; who would dare try again? Well, maybe this time, errrm, it’s different.

You might not have noticed it, but last month saw the most successful IPO in the UK equity market in a generation and possibly in its entire history. Notably, it arrived, not on the LSE, but rather on the competing alternative to LSEG’s AIM, the Aquis Stock Exchange (AQSE).

How did this happen?

This is Andrew Webley, a web developer who set up his own company in 2010. The Smarter Web Company (SWC) offers web design, web development and online marketing services.

Notably, about a decade ago, Andrew discovered Bitcoin and decided to transform SWC into a Bitcoin treasury company. He followed the playbook of US Bitcoin evangelist Michael Saylor, and SWC adopted the policy of his company, MicroStrategy (MSTR), which has operated this way since 2020.

I wrote about MicroStrategy last year as it joined the NASDAQ 100:

Thinking the Unthinkable

Critical junctures in history cause us to think the previously unthinkable. Until a year ago, it was unthinkable to most that Argentina might unshackle itself from its Peronist roots of misery. Until last weekend, it was unimaginable to most, including many of its members, that the Assad family would flee Damascus, ending fifty years of Syrian oppressio…

Last month, Andrew listed SWC on the Aquis Stock Exchange.

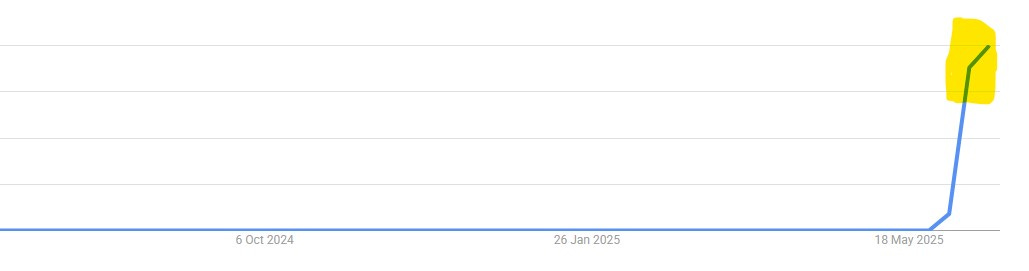

This is what happened to the SWC share price over its 6-week life as a quoted company:

By the close of play on Friday, with a share price of 542p, the SWC had a market value of over £1 billion.

But this is abnormal, a one-off, right? It’s a fad that won’t last. This is just gambling, financial nihilism gone mad.

Perhaps, it’s all these things, just a bubble. However, a bubble is just a bull market that you are not involved in.

As Joe Bryan, the maker of the viral Bitcoin film, What’s The Problem?, said to me recently, the adoption of Bitcoin would be more profound than the adoption of the internet.

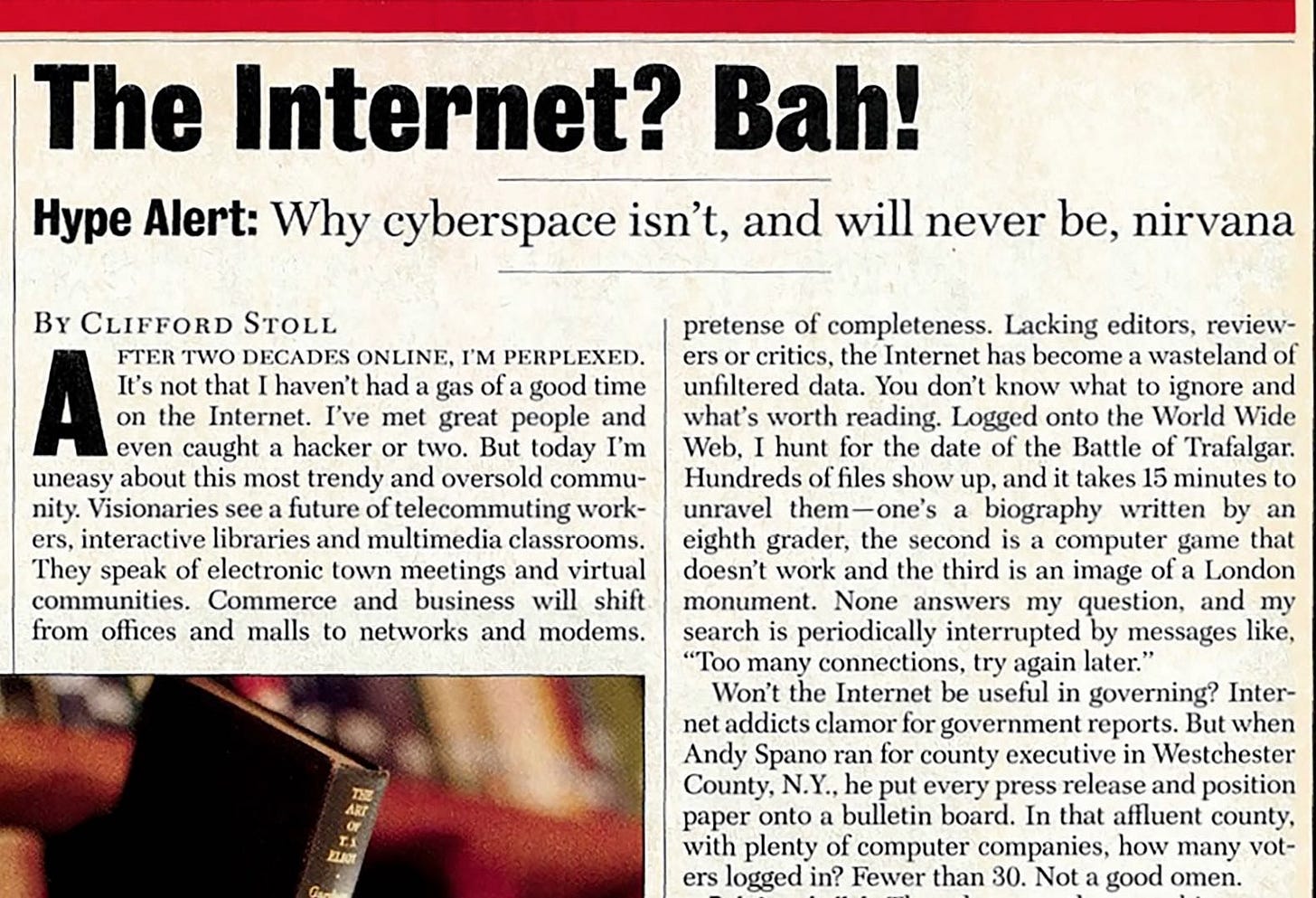

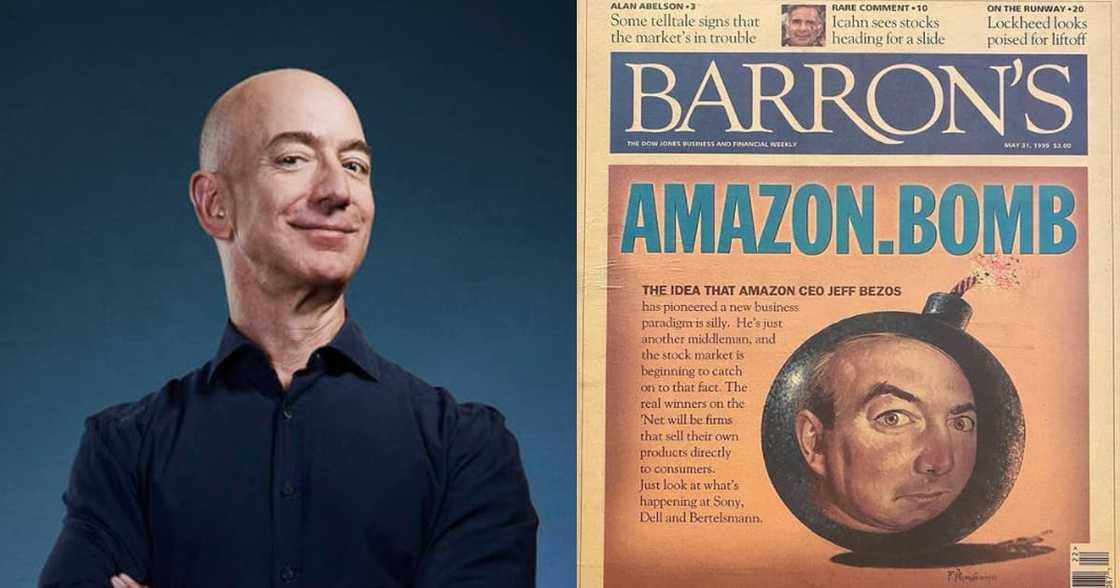

But the internet was obvious, though, wasn’t it? Well, no, as the following headlines show, not really.

In addition to examining the history of technology adoption and the bubbles new technologies created, take a look around you.

This is the MSTR share price since it adopted its Bitcoin treasury policy in 2020:

This is MetaPlanet in Tokyo, a hotel operator that adopted Bitcoin treasury in April this year:

And this was Friday’s share price performance of various UK microcaps that all announced various intentions to adopt Bitcoin or have already started to stack coins on their balance sheets:

Whatever you might think about this, the cost of capital for these companies has collapsed. Some of these companies will be unable to utilise this newly endowed capital, and others will squander it. Charlatans will run through this chaotic scene and fleece the unwary. This is the way of bubbles back to the dawn of time. Be informed, be prepared.

As Thomas at Aberdeen goes about his business with a bigger smile on his face, armed with capital seeking traditional dividend-derived value, the UK-listed smaller companies market is about to be swept up by crypto investors seeking wormholes into the regulated waters of traditional finance. This will be significant, as it will produce both substantial value creation and value destruction opportunities.

The shaded area above represents the army of underemployed London corporate brokers’ weekend reading.

Free advice (bear in mind you get what you pay for) for Boards of all listed companies struggling with the steep cost of (or non-existence of) equity capital. Learn about Bitcoin as a treasury reserve asset, if only to make sure you properly understand it before dismissing it as a fad. And prepare for the time you might have to explain why your competitors grew quicker than you, because they took this step and transformed their cost of capital.

These are two possible versions of the future:

Understand which side you are on, learn, and be prepared for things to change abruptly.