Gold is money; everything else is credit, John Pierrepoint Morgan, 1912, the year before the formation of the Federal Reserve.

Inside money is all the claims that are someone else's liability, and outside money is the type of money that is the liability of no one, Zoltan Posvar, Odd Lots Podcast, October 2022.

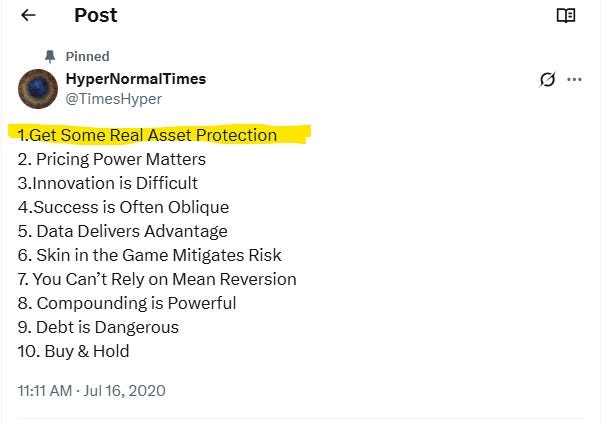

HyperNormalTimes is five years old. The first blog post in 2020 was titled "Prepare for Inflation." A piece of advice (which, of course, it wasn't) that has stood the test of time.

As policymakers fought the pandemic with reckless monetary and fiscal loosening, the piece concluded that:

The impact of an artificial and manipulated government bond market, quantitative easing and helicopter money will lead to higher inflation over the longer term. Bonds have become political, not financial assets; they are the central instruments in the sleight of hand that is being perpetrated upon us.

It used the last period of elevated inflation, the 1970s, as a reference:

In the period from 1970 to 1980, the average UK house price went from £5 000 to £25 000 (5x), the price of gold from $38 per oz. to $600 per oz (15x) and the price of a barrel of oil went from $2 to over $100 (50x). The lesson is that the things that were in relatively fixed supply fared well. House prices only just beat the rate of currency debasement over the decade, but gold and oil both did significantly better.

I was recently congratulated on the success of this hard money strategy, which has benefited from the strong price performance of Bitcoin and gold, both of which I have owned in various forms over the past five years. The compliment was well-intentioned; however, I sensed that it was made in a different context from the one in which my plan was initially conceived.

In essence, the misunderstanding arises from a difference in perspective, particularly regarding the standard for measuring success. You might think I'm being pedantic, but it's fundamentally important. From one perspective, it is akin to picking a few good stocks; from the other, it is an insurance policy against the implosion of the financial system. The difference between buying Google for $5 in 2005 and successfully stocking up on canned food and bottled water ahead of the outbreak of World War III. The former is an unmitigated success; the latter is more nuanced.

My strategy was being assessed with a faulty ruler. The accepted measure by which all investors compare value across asset classes is currency, specifically fiat currency (inside money), such as the pound, dollar, or euro. Crucially, the relative success of a hard (or outside) money investment strategy is a result of the corruption of fiat currencies, which also renders them unreliable standards for measurement.

However, for all their faults, we are well accustomed to using fiat currencies to transfer relative value across space and time. It facilitates exchange. It is fundamental to economic activity and progress.

But value is subjective, a unique assessment that differs for each individual at different times. It is the economists' version of a quantum particle. We know it is there, but, like Schrödinger's cat, it lives in different states concurrently and can't be captured and directly measured. Hence, economists talk in terms of revealed preferences.

As Warren Buffett described it in his inimitable aw-shucks way,

Price is what you pay; value is what you get.

Like beauty, value is in the eye of the beholder. While the price of something, objectively observable and measurable, usually differs from what most people regard as that thing's value. If this were not the case, trade wouldn't happen.

Money, as a medium of exchange, simplifies the transfer of value. The symbiosis of trade enables the mutual accumulation of value, making us wealthier. Over time, we congregate around generally accepted measures of value to expedite transactions that we hope will enrich us. It is a fundamental axiom of capitalism, the lifeblood of our extraordinarily complex modern existence.

Money, as a unit of account, plays a similar role to other standardised measures, such as those for time, length, or weight. And, just as we have institutions for the oversight of standard measurements in the physical world (such as the National Institute of Standards and Technology), we have institutions, like central banks, to oversee our currency. I suspect you don't need me to point out how lamentable central bankers and other policymakers have served us in this latter regard.

In a world of exorbitant budgetary irresponsibility, monetary policy has become overshadowed by fiscal policy, a phenomenon known as fiscal dominance. In recent weeks, we have learnt that the DOGE project was just political theatre. Elon Musk has left the building, sounding off about the recklessness of the Big Beautiful Bill. It is a thousand-page abomination of pork-filled budget-busters, casually extending the government debt ceiling by $ 4 trillion on its last page. A statute that legislators will pass but never read represents the Trump administration's reverse ferret on fiscal restraint.

This massive policy pivot represents a return to the Bidenomic spending and Yellenomic financing. Rather than directly confronting the exponential rise in debt and its funding costs, the administration is pretending the problem doesn't exist, a tacit admission that the fiscal spending train cannot be stopped.

The 10-year Treasury yield cannot be tamed; term premia will run rampant. The only policy option left is to juice the economy to try to outrun the debt. Yet, when the Secretary to the US Treasury has to appear on prime-time Sunday morning TV to tell US citizens that the country is not about to default, you know there is a problem.

Of course, Bessent is right; the US is not about to default. However, in hard money terms, it is insolvent. Its debts will just never be repaid in anything like today's dollar value. The trick, the sleight of hand, is that it all depends on the accuracy of your ruler.

Meanwhile, the world trading system is being turned upside down with TACO (Trump Always Chickens Out) tariff policies. To date, tariffs have questionable revenue-generating potential, yet they unquestionably undermine confidence in the dollar trading system and the role of Treasury bonds as the world's premier reserve asset.

There are only two 'solutions' to this problem: either the US must revise its fiscal policy (slim chance), or the non-dollar value of the US debt must decline materially until it becomes affordable enough for foreign investors to return. Rates need to rise, and/or the value of the dollar needs to fall, both in relation to other fiat currencies (the DXY) and with regard to its purchasing power.

The upshot is that sooner or later, the only way out is for the money printer to go brrrr, again.

As Paul Tudor Jones, the legendary hedge fund investor, said,

All roads lead to inflation.

At the risk of repeating my underlying structural concern of the past half-decade, investors must obtain real asset protection. But what does this imply today?

Just as was the case in the 1970s, investors should be long scarcity and short abundance. My interpretation of these fundamentals includes value equities, gold, and Bitcoin and avoids bonds, credit, and their close proxies.

A defining feature of national economic success increasingly rests on the acceptance of the hard realities of the modern world. Pretending a country can have a steel industry without a viable energy policy, pretending we can have a secure defence policy without a steel industry, and pretending we can tax and regulate an economy to grow are all the results of taking soft policy options instead of understanding fundamental hard truths. However, beneath the surface of all these missteps lies the corruption of our money, allowing our political class to believe they can bend reality to their point of view.

As Elon said about the Falcon 9,

We’re trying to do things that are physically possible but have never been done before. The laws of physics are not negotiable, but how we apply them can be creative

His old BFF, Donald, is perpetuating the myth that policymaking can outrun physics. Ultimately, there is only one winner.

A footnote on oil:

Between 1970 and 1980, the oil price rose 50 times in dollar terms. It was scarce for the whole decade, not due to geological factors but rather due to politics. Oil's scarcity resulted from the prevailing geopolitics and the formation of the OPEC producer cartel.

By 1986, the oil price had lost 85% of its dollar value from its peak in late 1979. The North Sea and Prudhoe Bay, which precipitated this decline, were necessary feats of engineering rather than geological science. The oil price effectively remained below $25 a barrel for the next fifteen years.

Energy, Populism & War with Doomberg

I recently had another chance to talk to Substack’s No. 1 financial commentator, Doomberg, as he dialled in from his chicken coop in flyover country.

Today, advanced hydrocarbon extraction technology, perhaps the most underrated wonder of the modern world, has rendered OPEC impotent once again. As Doomberg told me recently, the oil companies know where it is when they need it; the idea of peak oil is as absurd as the concept of our proximity to net zero.

Due to our political squeamishness about adapting our environment to improve humanity's well-being, a proven and tested source of unparalleled human flourishing, the world now relies increasingly on the US and its Western hemisphere of influence for our energy needs. North America is the undisputed bastion of energy abundance and is now exporting this prowess (fracking capability) to Latin America and, aspirationally, Greenland.

Increasingly, 'Drill Baby Drill' is driven by AI, humanity's latest energy derivative, whose primary molecule for data centre applications is natural gas, not crude oil. The more energy we feed AI and the greater access we give free thinkers to AI's extraordinary output, the more likely we are to find a solution to human-induced global warming, such as the commercialisation of nuclear fusion.

Do you think we could have some juice or is Reeves just going for the squeeze?