The Fallacy of Normality: Scottish Mortgage, China, & Money

I asked ChatGPT two questions about normality.

Me: What is normal?

ChatGPT: Normality is a statistical concept which refers to the degree to which a set of data follows a specific probability distribution. The most commonly used probability distribution is the normal distribution, a bell-shaped curve describing the frequency of a given data set. Normality is important to understand because it is used as a basis for many statistical tests, and it is also important to understand how the data is distributed to interpret the results of those tests.

Me: Is normality a desirable state for humanity?

ChatGPT: The answer to this question depends on the individual’s opinion. Some people may believe that normality is a desirable state for humanity, while others may disagree. Ultimately, it is up to each individual to decide whether or not they believe normality is a desirable state for humanity.

Set to Normal As the bot says, for some people, normal is a desirable state to which we should strive to return. Others seek the nirvana of a new version of normal involving policy nudging or coercion to achieve their objective, often called a new normal. For others, normal is just a setting on their washing machine. Nothing more, nothing less.

Scottish Outlier As a young fund manager in the early 2000s, Tom Slater, presented as normal. Fund management attracts lots of people like Tom. However, Tom worked at an investment partnership in Edinburgh that is distinctly abnormal. Baillie Gifford looks at the World differently from other mainstream fund managers. It eschews normality and looks for outliers.

No Benchmark While most institutional investors manage risk using benchmark indices, Baillie Gifford rejects this idea. Instead, BG follows the work of several relatively obscure academics, such as development economist Carlota Perez and financial economist Hendrik Bessimbinder and the work of the multidisciplinary Sante Fe Institute that develops thinking about complex adaptive systems.

Their Own Normal Tom Slater now manages Baillie Gifford’s flagship fund, The Scottish Mortgage Investment Trust, an £11bn constituent of the FTSE100 and a globally recognised investor in growth companies. Tom describes the investment culture of Baillie Gifford as entirely normal. Having developed within it over three decades, this is hardly surprising. Tom and BG believe that life-changing breakthroughs do not come from those who see abnormality as an unsustainable deviation from a previously known or aspirational normality. Breakthrough achievement comes from those who see a World that most of us do not see. They live in their own normal.

Pin Pong Outlier In his book, Bounce – How Champions Are Made, Matthew Syed said he couldn’t understand why there were more national standard table tennis players in his postcode area of Reading than in the rest of the UK combined. The UK’s table tennis talent was abnormally distributed, and Reading was a fat tail, an outlier.

Passion Play For Syed and his friends, it was normal to play table tennis every day under the guidance of a teacher with a passion for ping-pong and a head teacher happy to provide the resources. Similarly, it was normal for Lionel Messi to play football and Keith Jarrett to play the piano every day from age three. (An enraptured fan once said to Keith Jarrett, “I would give my entire life to play like you”. He somewhat mournfully replied, “I have”).

Tesla A few years ago, Scottish Mortgage’s largest investment was in the EV company Tesla. Tom Slater and his former boss James Anderson started buying shares in Tesla in 2013, which by the end of 2020 had delivered their investors a 10-fold return. Most other institutional investors remained anchored to the norm that the World didn’t need another car company, and Tesla was not worth more than the rest of the global car industry combined.

Musk For Elon Musk (who, as an autistic boy in a dysfunctional South African family, grew up thinking it was normal to read the Encyclopedia Britannica in its entirety), the global automotive industry was not the yardstick. Rather than making and selling metal boxes on wheels, Musk saw his vehicles as a means to gather data in a connected future of autonomous driving and transportation as a service. While not yet fully vindicated in his vision, the needle of public opinion has moved decisively in Musk’s direction over the last two decades. Scottish Mortgage has since sold c.80% of its Tesla shares, yet it remains the third largest position in the fund.

Moderna The largest position in the Scottish Mortgage portfolio today is mRNA pioneer Moderna. Moderna was an investment the BG team initiated in 2020 when it became an unexpected candidate in the race for the COVID vaccine. After an eight-year existence and an undiminished faith in its mRNA technology, Moderna had yet to produce a commercial product. While most investors assumed that industry leaders such as J&J, Roche, or Glaxo would win this vital race, BG went for the outlier.

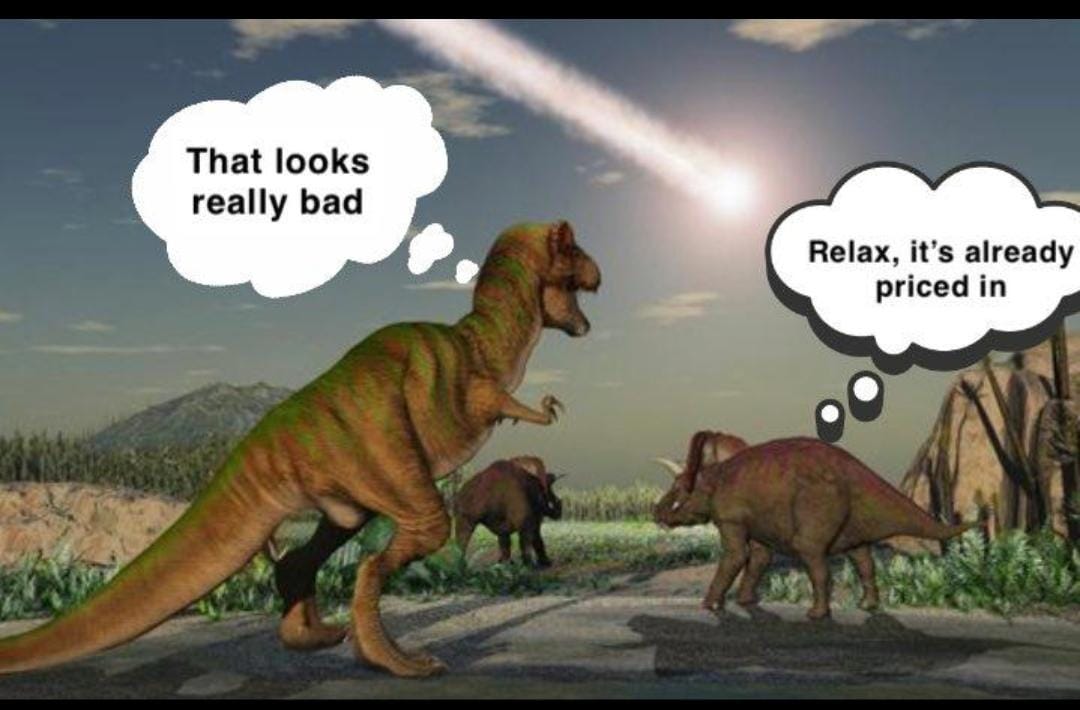

Right Place The annual revenue performance of Moderna over the three years to 2021 is unsurprisingly abnormal: $60m, $800m and $18.5bn. A financial representation of the 48 hours it took to develop the vaccine formula, the additional six months to conduct human trials and the ensuing global frenzied demand for its blockbuster product. There is nothing normal about being in the right place at the right time when a global pandemic hits. When the asteroid hit earth 58m years ago and wiped out 90% of all life forms, our small mammalian ancestors were perfectly positioned. (See the dinosaur meme above for details).

COVID’s 3rd Birthday Three years ago this week, Chinese authorities fessed up to a novel coronavirus about which rumours had been growing in Wuhan province but had been violently suppressed. In the following two days, the Wuhan Institute used Illumina’s sequencing technology (another successful BG investment) to distribute the identity of the COVID-19 virus globally. Two days later, Moderna scientists had the code for an mRNA vaccine that was later proven to be 94% effective. A four-day solution that has taken most countries much of the following two years to implement effectively.

Not in China However, China was a notable exception. Having rejected western medicines such as the Moderna vaccine and continuing to lockdown its people, China exacerbated the World’s post-COVID economic dislocation. Social pressures built, and economic performance declined. China hesitated as the rest of the World opened up, piling untold costs and privation on its citizens.

China Changing? As we get into 2023, things in China are changing rapidly. A loosening of its Big Tech regulations and the lending criteria for the real estate sector both followed on the heels of its zero-COVID u-turn. As Tom Slater was at the Scottish Mortgage investor event last week admitting he was late in reducing BG’s exposure to China, Chinese equities were catching investors’ newfound New Year appetite for risk assets. The NASDAQ Golden Dragons Index of listed Chinese companies is up 15% YTD.

Xi Relents? China bulls see this as evidence that Xi has capitulated on his previous authoritarian go-it-alone approach. According to this view, following his Indonesian handshake with Biden in November, Xi now accepts the continuing symbiosis with western consumers as his best option to deliver prosperity to his suppressed citizenry. One obvious further test of this hypothesis would be if China were to approve and purchase the Moderna mRNA vaccine.

Transitory Soft Landing? Partly because of the unpredictable events in China and the uncertainty surrounding its reopening, everyone appears to be reeling in their previous bearish and doom-laden economic predictions. Jamie Dimon and Paul Krugman are among the opinion formers now pointing to the possibility of a soft landing for the US economy, previously having warned of an imminent and severe recession. Dimon moved from warning people to brace for an economic hurricane six months ago to admitting he now has no idea what will happen, but whatever it is, JP Morgan is ready to serve its customers.

Financial Normalisation Jamie Dimon and others on Wall Street have renewed confidence that the World’s financial conditions can normalise. A risk-free rate in touch with prevailing inflation allows financial markets to normalise and, critically, sovereigns to raise debt. But markets habitually disrupt such consensus. (Watch for heightened US political theatre over the $31tn US Federal Debt ceiling later this year). Yield curve inversions and evidence of bond market illiquidity abound. Such factors indicate that our cheers for disinflation could soon make way for deflation fears and dysfunction. The robust performance of precious metals and bitcoin (remember them, distinctly abnormal) reflects these concerns.

Chinese Normality Since its admission to the World Trade Organisation in 2001, China has been on a growth trajectory we have come to accept as normal. Such received wisdom informs us that China will be the World’s largest economy and superpower by 2030. But less attention has focused on the reality that India will overtake China as the World’s most populous nation as soon as this year. What is clear is that the path China takes over the next few years is critical for global economic growth. Longer term, just as the West’s economic arch nemeses were the Soviet Union in the 1960s and 70s and Japan in the 80s and 90s, future Chinese global domination is not inevitable.

Jeremy

15/01/2023

The post The Fallacy of Normality: Scottish Mortgage, China, & Money appeared first on Progressive.