It’s a fixer-upper of a planet, but it has potential. Elon Musk.

The Trump win is a victory for the techno-optimistic accelerationists. Silicon Valley outsiders such as David Sacks, Marc Andreessen and, most prominently, Elon Musk form an overtly pro-risk, pro-innovation and pro-growth strand to the Trump coalition.

While the US economy and stock market have performed strongly over recent years, the forcing function of passive capital and the lure of an AI nirvana created a highly concentrated global equity market. However, this concentrated form is changing.

The Trump Trade has dispersed the market among second-tier technology and smaller capitalised stocks, reflecting an environment more conducive to entrepreneurial risk-taking. Unsurprisingly, Tesla has been the best-performing Mag Seven stock since November 5th. However, if any business is poised to benefit from this new era of accelerationism, then Musk's real passion project, SpaceX, is it.

The Vision of SpaceX

Musk set up SpaceX to make humans a multi-planetary species, and he has remained committed to this ideal for over two decades. He has been dismissed as a deluded billionaire and criticised as a selfish fantasist who could and should do more good in the world via effective altruism.

However, the human brain doesn't cope easily with exponential change, and only recently the world has woken up to the consequences of Musk's audacious belief. While the media obsession remains his ownership of X/Twitter, most miss the more profound implications of his Occupy Mars movement.

The SpaceX mission is simple and challenging: "to revolutionise space technology, with the ultimate goal of enabling people to live on other planets." Critically, because gravitational force decreases with the square of the distance, its most significant challenge is getting off the Earth's surface and into orbit. Once there, going anywhere else is relatively cheap and easy. Therefore, reducing payload launch costs is crucial.

Musk's team estimates that one million tons of cargo must be landed on Mars' surface to colonise it sustainably. To achieve this, SpaceX required a large re-useable rocket. The recent launch and recapture of the giant Starship reduces the cost of launching a kilogram of matter into orbit from over $1m a few years ago to the equivalent cost of domestic parcel delivery. The consequences of this development are as profound as they are underappreciated. Let's do some star gazing and speculate on the future of the space economy.

Dominating Global Communications

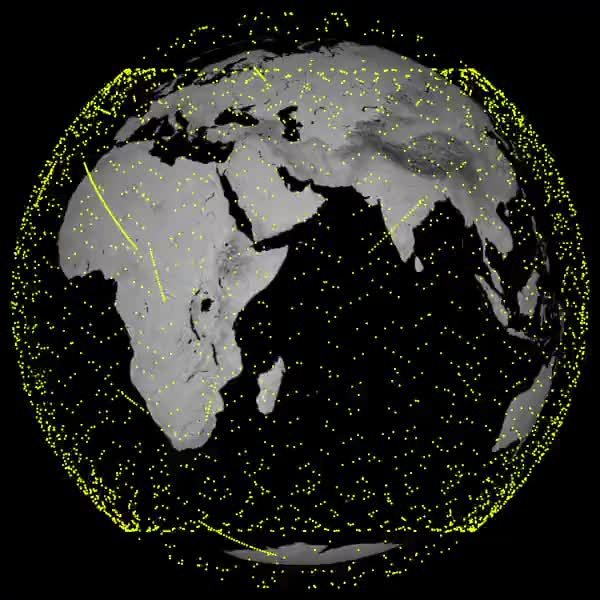

SpaceX's most visible consumer presence is its communications constellation, Starlink. Starship enables a far quicker deployment of Starlink's scale and depth of product offering, giving it scope to become the world's largest subscription business direct-to-device. The disintermediation of earth-based fixed and mobile networks for consumers, businesses and governments offers a multiple of what Netflix offers, which today boasts $33bn in revenue from 250 million subscribers and a market value of $400bn.

Baillie Gifford analyst Luke Reustle pointed out that the US DoD recently increased its Low Earth Orbit satellite-based services program from $900 million to $13 billion due to surging demand for orbital connectivity from its forces in the field and perhaps explains why Trump dialled in Musk for his recent call to Volodymyr Zelensky.

Space Manufacturing

A conventional company would no doubt think that the Starlink opportunity is sufficient. However, it is just a staging post when you are drawn onwards by the lure of interplanetary colonisation. Beyond Earth-based communications, Starship's scale also realises the dream of space manufacturing and more. Many new opportunities present themselves with a payload equivalent to an Airbus A-380 and a radically lower cost structure. These include chemical and industrial processing, the operation of data centres, solar power generation, and even moon or asteroid-based resource extraction.

Luke Reustle, again

The International Space Station took about ten years and 36 Space Shuttle flights to build and assemble. The Starship's cargo bay is big enough to launch something the same size in a single afternoon, potentially costing less than 0.1% of the ISS.

Orbital Travel and Transport

A cost-effective, reusable Starship also opens up many Earth-based orbital travel and transport opportunities. Consider the next-day delivery, business and military potential of an orbital vehicle that can deliver 200,000 kg of goods or people anywhere on Earth in 40 minutes for $2m a trip.

Valuing SpaceX

So much for the stargazing; how can this opportunity be valued? Although privately held, SpaceX does have some valuation reference points, such as periodic fundraising and secondary liquidity events. Bloomberg recently reported that,

SpaceX is in talks to sell insider shares in a transaction that would value the rocket and satellite maker at about $350 billion. This is a significant premium to a previously mulled valuation of $255 billion last month and the $210 billion in a tender offer earlier this year.

Going Dutch

It is often worth reflecting on what company SpaceX might be similar to. For this, it is worth going back four hundred years to one of the very first joint stock companies and what, market-adjusted, remains the world's largest ever company: The Dutch East India Company. Like its modern pioneering comparator, The Dutch East India Company had ambitious goals of expansion beyond established boundaries, challenged traditional ways of doing things, and operated as a private company but had significant political power, often blurring the lines between private enterprise and governmental authority.

Analogues are always flawed, and Spacex and the Dutch East India Company also differ significantly. However, SpaceX, a champion of US national capitalism, like it or not, its monopoly space economy opportunity will be underwritten by a Trumpian techo-optimist dreamworld. As such, it looks set to join the very largest of our Earth-based companies.

>