The Bear Market Rally, Fed Pause Button & Energy Bubble

Bear Market Rally

The equity market rally since mid-July is dissipating with the hot weather, strengthening suspicions that it was only ever a bear market rally. Investor expectations and positioning were as negative as those immediately before the GFC. While recession seems inevitable in the eyes of everyone except Joe Biden and Jay Powell, the downturn’s length or depth is far from clear. For the time being, the Fed and the BoE continue to tighten into weakening economies which is inherently risky for markets, particularly with such high levels of indebtedness and supply constraints.

Pause Button

While the direction of interest rates remains upward, there is increasing scrutiny of central bank comments for signs that we might be closer to pressing the pause button. As they gather this week in Jackson Hole, there will be more opportunities to glean such clues. However, the rate of change in inflation has slowed, and specific lagging contributors (housing costs) are causing the official measures to be sticky. At the same time, forward indicators still suggest inflation rates will start to fall later this year. Meanwhile, investors are currently evenly split regarding the probability of a 50pt or 75pt rise in rates at the September Fed meeting.

Monetary Tightening

The question remains how quickly can the inflation dragon be slain, and then how soon after it is safe (i.e. not reputationally damaging) for policymakers to push the pause button. In his amusing Adventures in Capitalism blog, Harris Kupperman said: They have convinced people that they’d go full-Volcker and take rates into the teens, but we all know they won’t. A pause is inevitable. Yet, the timing remains challenging.

Fiscal Loosening

There is a much more significant, even a universal, propensity to consider fiscal loosening, specifically targeted at mitigating energy costs. Politicians in Europe are proposing different methods of protecting consumers and industry from the harsh reality of the price mechanism for energy. This is potentially career-ending for Western political leaders. The media chorus can be summarised as, “do something, anything.” Expect more from the UK perspective in September’s emergency budget.

Endemic Inflation

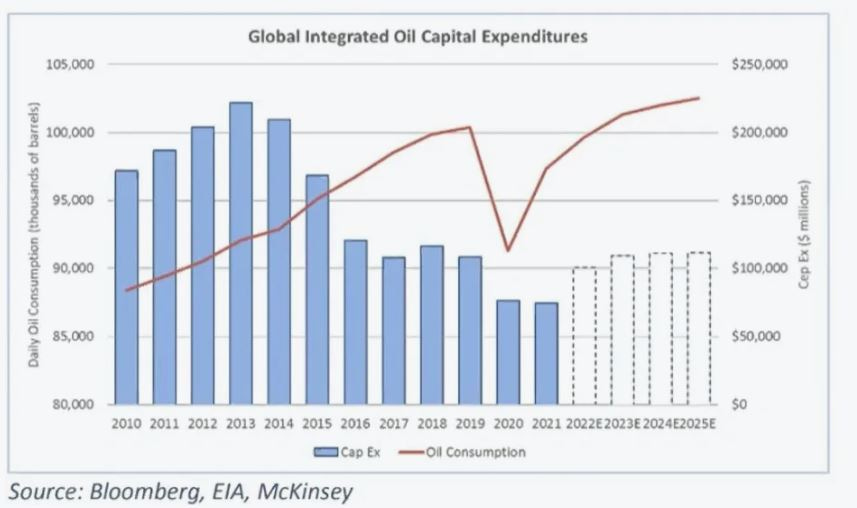

European economies will soon have one foot on the (monetary) brake and one foot on the (fiscal) accelerator, while the structural challenge is to fix the energy market’s supply side. The below chart illustrates this is not going to happen overnight. Indeed, the risk remains that when policymakers try to re-stimulate growth, they will quickly run into energy supply challenges, which is inherently inflationary. Short-term inflation may have topped out, but it is not going away.

Dollar Strength

The USD index, the DXY, pulled back from its recent tear easing global financial pressure. However, the DXY seems to be re-exerting its upward pressure again as other central banks cannot keep up with the international policy rate arms race. (China surprisingly eased policy last week). This Dollar wrecking ball takes no prisoners, and weaker indebted countries with USD debt and low reserves will follow the path of Sri Lanka. European economies, including the UK, will not be immune from this transmission pressure on currencies and imported inflation.

Energy Bubble

Energy remains the best-performing equity sector YTD. However, valuations remain low in absolute terms and by any historical standard. Fixing the energy supply chain has become the dominant economic and political narrative, overpowering previous absolutes such as ESG “renewable only” orthodoxy. Serious discussions and proposals are underway for nuclear capacity extension, exploring locally sourced natural gas and previously unimaginable fracking. Long energy, priced in USD, could continue to sweep all before it. The energy bubble may yet be at its formative stage.

Jeremy

Ealing

The post The Bear Market Rally, Fed Pause Button & Energy Bubble appeared first on Progressive.