Recession & Breathe

Recession already

The US economy will likely announce its second consecutive negative GDP print for Q2, officially putting it in recession. A consequence is that inflation will start to fall, possibly quite sharply, later this year. Employment, a lagging indicator, remains resilient but is likely to weaken as it becomes more widely accepted that things are heading down.

Too much stuff

Demand destruction is in full swing as we relearn the adage, “the cure for high prices is high prices”. We are witnessing a real-time cobweb model of time-delayed supply and demand decisions classically describing agricultural market volatility. A year ago, there were chronic shortages. Since then, the world has rebuilt inventory levels faster than at any time in recorded history. The narrative has been of challenged or broken supply chains. In reality, Amazon has too much warehouse space, and Walmart and Target have too much stock. (If you know how to short second-hand cars, it might be worth a try).

Falling commodities

Most headlines are talking about unprecedented inflationary pressures. In reality, the prices of most non-energy commodities are trading significantly below their recent highs, including industrial metals, soft commodities and shipping. From what TSMC, Intel and Samsung are saying, we are not that far away from significant increases in semiconductor supply (well, maybe 2-3 years).

Energy is different

The oil price remains in its wide post-Ukraine range of $100 – $120 a barrel but is generally lower over Q2. Gas remains highly volatile, with pricing widely dispersed by geography. European gas prices are 15x higher than in 2020, and spreads on exporting US gas to Europe are insane. The RoI for installing LNG importation facilities in Europe is off the clock. They cannot be built quickly enough. The interim fix remains more coal-burning and nuclear expansion. (Thermal coal and uranium prices both remain firm).

Germany v. Russia

Critical to the energy equation is the European arm wrestle between its largest manufacturer and its largest energy supplier. Europe’s economic competitiveness is declining, and Russia is raking in record export cash flows. (The Ruble has very significantly outperformed the Euro since the invasion). Germany’s structural trade surplus, the engine of European growth for decades, has just evaporated. Germany cannot survive winter without Russian gas. In reality, Germany needs Russian gas more than Russia needs Germany’s money. Russia gets much more revenue from oil than gas. Oil is fungible, and there are many willing buyers for discounted Russian crude, much of which is blended and refined with non-Russian grades. Russia can afford to limit gas supply thwarting German attempts to refill storage capacity while the sun is shining in Europe. Both sides are desperately building new infrastructure to buy or sell gas in new markets. European gas prices will likely remain elevated until this infrastructure is in place.

Oil price is vulnerable

Oil is likely to be the last shoe to drop in the current commodities complex downturn. The oil price tends to be inversely correlated to the USD. By this measure, the oil price is currently significantly overvalued. The most apparent explanation for this overvaluation is the current supply constraint. The oil price is highly exposed if peace breaks out in Ukraine or the Saudis pump more oil for Joe Biden’s re-election campaign. In such scenarios, the oil price could halve, causing a deflationary shock and boost to consumer confidence/spending.

Tightened

As financial conditions tightened, the world’s liquidity drained. The US has been able to raise rates more than most, squeezing liquidity from different places. Global money supply growth has reached zero from a peak of 20% in 2020/21. This deflationary combination has caused pain to both indebted countries with weak economies and risk assets absent cashflows. Sri Lanka, unprofitable growth stocks and bitcoin have all taken a beating. The blow-up of Three Arrows Capital (a crypto hedge fund), crypto exchanges, stablecoins and de-fi ventures are a combined dot-com bust and LTCM event in one go. Even the crypto Winter might start to thaw soon.

The dollar remains king

The trade-weighted USD index is at levels not seen for 20 years. Up 12.5% YTD, its strength is exacerbated by the weakness of both the Yen and Euro, where each monetary authority finds it much harder to raise rates. Europe is facing an energy crisis with worrying signs of diverging yields, and Japan is capping long-duration bond yields via effective yield curve control. Longer-term, countries will likely look to diversify their reserve assets away from the USD, but not for now. Recent USD strength can continue.

The tightening will stop

Amidst all this, US bond markets are starting to price Fed rate cuts for 2023. Markets expect the Fed to keep tightening through 2022 but turn more dovish next year as economic conditions deteriorate. Expect more rate hikes in July and September, but beyond that point, it will prove harder for the Fed to keep tightening. The 10yr bond yield remains critical. 3.5% looks like a significant cyclical top and could fall back sharply when the recession hits home.

And breathe ....

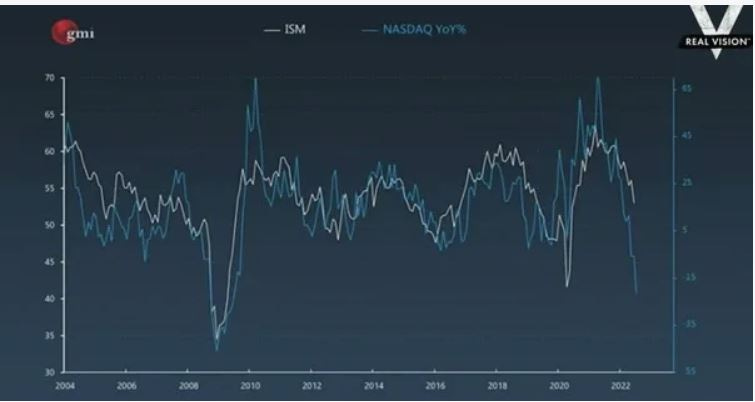

As the tightening moves to easing, investors can start to breathe again. The US ISM correlation to the year-on-year change in the NASDAQ composite time series fits well. It suggests that equities have already priced in bad news (an ISM print well below 50 and maybe below 40 equates to a 2008-style downturn). (Chart courtesy of Raoul Pal of GMI/Real Vision). Similar relationships exist with other equity indices. Markets are expecting a short sharp recession. Of course, the reality could be steeper and longer than the market expects. But, much of the type of downturn we have seen historically is already assumed.

Concluding thoughts

None of this means we are in the clear for an equity market rally. Many naked swimmers have yet to reveal themselves in the ebbing financial tide. While there are attractive pricing anomalies in chaotic sell-offs, watch for distress flares to be launched as revised earning expectations meet over-leveraged balance sheets and thin margins. Markets can normalise, but determining success from failure never ends.

Jeremy

Ealing

The post Recession & Breathe appeared first on Progressive.