Our Pessimism Preference & Its Benefits

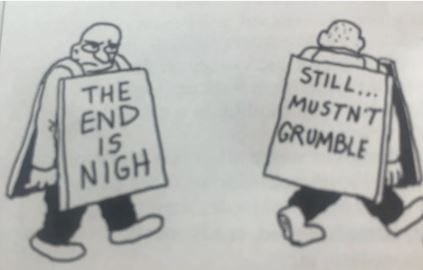

Darwin Prize for Gloom

The human brain is seemingly hard wired to adopt pessimistic opinions and viewpoints about our world and its future, rather than its optimistic alternatives. In the process of analysing investment opportunities, a list of the reasons to make the investment will invariably be shorter than the opposing list of reasons not to make the investment. After several decades working on the sell side in equity markets I have contemplated writing the Book of Fund Manager Excuses. Evolutionary theory suggests that we have benefited from having an asymmetrical appetite for risk. Our ancestors in the savannah who chose stay calm and optimistic invariably became victors of their own Darwin Prizes, for which we should be grateful. But what it has left us with is a frequent and compelling certainty of our cataclysmic demise, while we are inclined to an indifferent or even hostile approach to ideas of hope, optimism and growth.

We're Doomed!

The popular reasons for our presumed decline, lurch into poverty and inevitable annihilation changes over time, but the doomsayers lament remains constant. In the early 1800s there was a famously pessimistic economist called Thomas Malthus who wrote an Essay on The Principle of Population. He made the intuitively appealing observation that as the world’s population was growing geometrically and that the resources required to sustain it were only growing linearly. Humanity was destined to succumb to severe bouts of famine and disease which would destabilise the world, forcing nations to fight for diminishing resources. Malthus’ ideas are well understood today and can be recognised in the form of GreenPeace, Extinction Rebellion, Greta Thonberg and Prince Charles. This is remarkable mainly because, in the last 200 years since he wrote his essay, Malthus has been proven totally and completely wrong in every regard.

Let's Trade

A contemporary of Thomas Malthus’ was a man called David Ricardo. Ricardo was an optimist, (he was a successful financier and businessman able to retire in his early 30s) and is most remembered for formulating what became known as the Theory of Comparative Advantage in Trade. Unlike Malthus’ Theory of Population, the Theory of Comparative Advantage is counter intuitive and has consistently proven to be correct and useful, forming the basis for the creation of multilateral trade and leading to institutions like the General Agreement on Tariffs and Trade and its successor organisation, the WTO. Ricardo and Malthus, while close friends who tirelessly discussed aspects of economic theory, took opposing views on the Brexit issue of their day, the Abolition of the Corn Laws. Malthus wanted to protect the land owners and preserve the nation’s ability to feed itself, while Ricardo was an abolitionist who understood the benefits of free trade and what we now know as globalisation. Ricardo, inspired by reading the Wealth of Nations, helped formulate the theoretical basis for the greatest period of economic growth, wealth generation and technological progress in the history of man, but is today hardly ever discussed outside the arcane academic circles of the History of Economic Thought. Malthusian doom laden message however, remains with us.

Insecurity Motivates

I have recently read an excellent book called The Psychology of Money by Morgan Housel. There is a chapter titled The Seduction of Pessimism where he explains the power our risk averse mentality. Bad things can happen quickly, such as acts of terror or the spread of a virus, while the daily grind of our collective daily toil to improve our world impacts over longer periods. Media reports of flood, disease, and wildfires are compelling in a way that reports on daily incremental improvements in our lives are not. (For reference here I would suggest that Matt Ridley’s offerings The Rational Optimist, The Evolution of Everything and How Innovation Works are well worth a read, as is the brilliant Factfulness by the late Hans Rosling). The reality is that we seem to need this collective preference to be scared (or at least highly cautious) about our future in order to stimulate our own development and improved adaptation to our environment. This explains why some of the most successful people in life are also some of the most insecure. Unless we worry about things, we will not act on them sufficiently.

Popular Delusions

When I was studying A level economics in the late 1970s the popular pessimism of the day was Conservationism, most widely acclaimed by Paul Erlich’s The Population Bomb and the sensational work of the Club of Rome, where early computer modelling outlined our Limits to Growth. Both books foretold of scenarios where the world would run out of scarce resources by the mid 1980s leading to famine and widespread societal upheaval. This was nothing short of a revival of Malthusian fear mongering, but the world’s media and political classes were compelled. The Ricardian defence was played by little known economist called Julian Simon. Simon wrote a brilliant book called The Ultimate Resource which outlines the counter intuitive theory of economic scarcity and also espouses the economic virtue of population growth and population migration, giving a large role to the ability of human ingenuity to overcome adversity. Largely ignored as a free market fantasist, Simon challenged Erlich to a bet in 1980 over the future price of key resources over the coming decade. Erlich selected a basket of five metals that he thought would rise in price with increasing scarcity and depletion. Simon won the bet, with all five metals dropping in price over the period. Simon challenged Erlich to a similar bet in the early 1990s, but Erlich declined. Interestingly, Erlich proposed that they instead wager on the performance of a set of economic and societal welfare measures as selected by the President of the National Academy of Sciences. However, Simon declined this blatant attempt to move the goalposts to a less rigorous, some might say even meaningless, set of measures.

Human Ingenuity

Daniel Yergen estimates that 86% of the World’s known oil reserves have been discovered not by geologists but by technological advancement of enhanced recovery techniques, like fracking and horizontal drilling. As recently as a decade ago investors and financial markets were again worrying about oil depletion, today the worry is the liabilities of stranded assets as we plan to leave recoverable oil in the ground. As Al Yhamani said, the stone age didn’t end because we ran out of stones. Human ingenuity is ultimately what helps us progress. The critical enablers on ingenuity are access to information, effective communication, freedom of expression and movement combined with well established property rights, so individuals and organisations can benefit from their insights. Julian Simon’s insights into the benefits of freedom of movement and population growth were inspired when he visited a memorial to the deaths in the Nazi concentration camps. While reading the names of all the victims, he pondered how many future Beethovens, Einsteins and Picassos perished under such dictatorial oppression. Today’s network technologies and amazing power of data processing allows access to all the World’s information via a simple handset. As the world is getting greater access to our collective knowledge, we have much greater chances of solving its known problems.

Need More Musks

Elon Musk has said that the limiting factor of human progress is our metabolic make up and the fact we cannot speak as quickly as we can think, (he refers to a favourite essay called They Are Made of Meat). He speaks of a future where AI will not have the patience for our slowness of communication and we will live as their house cats. Musk’s Neural Link is an attempt to overcome this issue and as he says allows for a greater chance of human survival. Musk is an optimist, pushing the frontiers of human development in several directions at once. He will inevitably fail in some of his endeavours, maybe all of them. At which point there will be a large cast of commentators ready to report on how inevitable this was. As Jeff Bezos said after he launched and then pulled the infamous Amazon Fire smartphone, if you think this failure is important, trust me were are currently working on much bigger failures right now. But what Musk and Bezos know about success is that it happens as a result of fat tail distributions, more of this later.

The post Our Pessimism Preference & Its Benefits appeared first on Progressive.