Not Dead, Just Resting

The UK market returns to life, but the $tn. company hunt will take longer - much longer

Mojo Back

Investors learned a few things about the UK last week. We are going to have a General Election on July 4th. Yawn. Inflation is stickier than predicted, and due to this and the previous item, the Bank won't cut rates in June. Okay? Finally, the stock market rediscovered its mojo without the much-demanded government action to mend things. Interesting!

Enough Already

No sooner had we learned more details about the Raspberry Pi IPO and watched our bedraggled Prime Minister say he'd had enough than the UK stock market delivered two rights issues worth £7.4bn (National Grid and Great Portland Estates). Along with several secondary offerings, including AJ Bell and FRP Advisory, the amount raised by our hitherto dysfunctional market totalled more than £8bn in just 48 hours.

Don’t just do something, stand there

Over recent years, like the Norwegian Blue, we did not know whether the UK's equity capital markets were dead or resting. There had been calls for urgent government action to rescue what was seen as symptomatic of Broken Britain. But the UK stock market didn't require 4,000 volts from the government or regulators. It just needed to be fed some liquidity by participants with different views of risk, and it sprang to life in its pursuit of price discovery.

Blown away

Yet, the market's sudden resurrection shouldn't have been a surprise; several positive straws have blown past in recent weeks. Much healthier price actions revealed higher liquidity flows from hopes of lower rates. This liquidity fueled improved net fund flows, record share buybacks, higher dividends, and increased M&A activity. On this latter point, last week alone, there were approaches worth over £7.5bn to UK midcap companies, Keywords (£2bn), XP Power (£600m), and Hargreaves Landsdowne (£5bn).

Barbarians in the boardroom

Significantly, given strengthening resolves in boardrooms and among investors not to roll over, announce, and accept such approaches at the first opportunity, this figure is likely just the tip of the iceberg. By extension, the degree of total PE and strategic interest in UK-listed assets could be 3-4 times this amount. The barbarians are at the gates of the UK public market. Perhaps it’s more of a case of Trojans in the boardroom without investors knowing, raising important issues of board fiduciary duty and transparency.

Improvements still needed

However, this does not mean everything is fine, and no further action is required to improve things. Jeremy Hunt returned to a favourite theme: making the UK market more like NASDAQ, when he recently told the FT, that he would like to see greater risk-taking among UK investors. Oblivious to how little time he had left to affect things.

What's my yardstick of success? I'd like to see a British Alphabet. I'd like to see a British Microsoft, a UK company with a $trillion market cap.

Existential risk

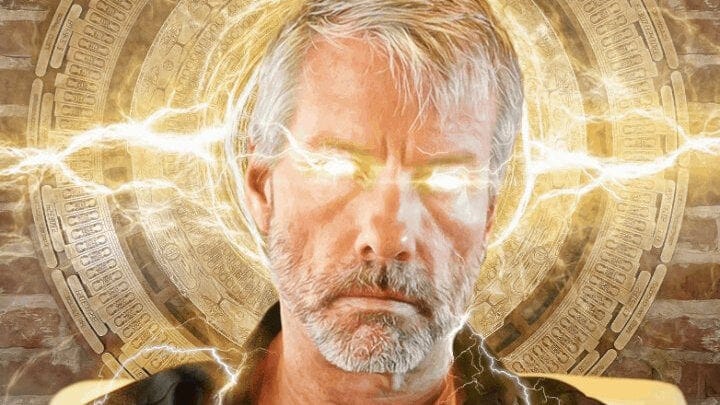

To realise Jeremy Hunt's ambition, UK investors must relearn the nature of risk. Specifically, they must develop the means to evaluate life-or-death risk and back ideas and people with the resilience (ideally antifragility) to adapt to a radically uncertain world. It requires backing genuine balls on the line risk-taking of the type Walter Isaacson described in his biography of Elon Musk. Risk-taking that only follows from the conviction of a total obsessive with skin in the game. How many UK public company executives would be allowed to take on the type of existential risks that Musk has with Tesla, Reed Hastings did with Netflix, Mark Zuckerburg with Meta and Michael Saylor buying all that Bitcoin at MicroStrategy?

Resilience

John Kay and Mervyn King think some uncertainties may be resolvable in light of further information and where some reasonably objective basis exists for constructing a probability distribution of outcomes. These risks the UK market can evaluate. However, radical uncertainties are not resolvable in such ways; we do not know what will happen, and we cannot even describe the range of things that might occur. This type of uncertainty requires resilience (or, even better, antifragility).

Jensen Huang talks about the importance of resilience in this short clip and how it is inversely related to expectations.

Regulate first

Martin Sorrell wrote last week that while the US innovates, China imitates, and the UK regulates. In a conversation I had with British entrepreneur Nick Prest, the founder and chair of the defence technology company Cohort, he said that the problem with regulation and compliance is that they drive out conscience and common sense. People think that when they have ticked the right boxes, they have absolved themselves of first-principles thinking, an observation apparent in the shallowest reflections of the Post Office Horizon scandal. Dominic O'Connell asked in his article, Would you pass the Paula Vennells test?

Which bits of you do you take to work? Do your beliefs, values and feelings travel with you? Or do you leave them at home and become a different version of yourself, someone who cares only about what will secure you the next promotion or make you or your company the most money?

Governance models

On governance Nick Prest also validly observed that no superior management model works for all companies regardless of circumstance.

Take the United States, where the Chairman / CEO concept prevails. Can anyone objectively argue that American companies run by Chairman / CEOs produce inferior results? [Compared to split roles preferred in the UK and Europe]. The evidence is just not there.

Don’t get it

Of course, not all companies, even those run by previously successful entrepreneurs, have resilience. Last week, online car retailer Cazoo entered administration three years after listing in New York. At that time, its British founder and CEO Alex Chesterman said that UK investors didn't understand high-growth tech companies that prioritise long-term growth over short-term profitability. He believed that US investors were more accustomed to Cazoo's business model and would be more willing to invest. And Chesterman had a good point. Cazoo listed via a SPAC deal in 2021, having declared a pre-tax loss of £100m on revenue of £162m the previous year, achieving a post-deal valuation of $8bn, an EV/Sales ratio of over 40x.

Done it before

Given Chesterman's previous successes with Love Film, sold to Amazon for £200m, and Zoopla, sold to Silver Lake for £2.2bn, he represents the type of entrepreneur the UK needs to retain and nurture. Never mind that Chesterman's businesses were all replicas of other successful online innovators (Netflix, Rightmove, and Carvana). His valuable experience alone makes him a backable entity, but he did the right thing by listing Cazoo on NASDAQ.

Them’s the breaks

In case you were worried, it didn't end badly for him. In September 2020, Chesterman sold shares worth £100m in a pre-IPO deal to "make room for new later-stage investors, " including Blackrock. He left the business in January last year as it was ravaged by spiralling interest costs and a rapidly changing car market that Chesterman and his successors could not escape. There were different versions of the future in 2021, which meant Cazoo could, like Lovefilm and Zoopla previously, have been bought by larger competitors or consolidators. This time, it was different for him, but as Bojo said, them's the breaks.

Embrace risk

Unlike actuaries and financial regulators, who equate risk to the volatility of return and seek to minimise it, Kay and King consider uncertainty unavoidable and welcome. Uncertainty gives rise to investment return and is, philosophically, fundamental to human life. Our very existence results from our relentless risk-taking to overcome entropy. As Nietzsche put it,

To live is to suffer; to survive is to find some meaning in the suffering.

Size the day

For investors, minimising risk does not mean eschewing 'risky' assets but evaluating how to incorporate them into their risk profile optimally. As Kay, who led an enquiry into the state of the UK's pension industry, later said,

Legal restrictions on trustee investments have cost widows and orphans far more than they had ever lost to corrupt or foolish trustees.

All-in

The critical message is that no objective meaning or measure of risk exists. The key question is, 'What risk?' and 'For whom?' Elon Musk has repeatedly gone all-in on new Tesla models, giga factories, and rocket launches. It worked for him, but such risk profiles would not work for 99.9% of people.

Prerequisites

However, if you have the right mix of Chestermans and Musks in a sufficient sample size, you have the long-tail prerequisites for the evolution of the Magnificent Seven or its next incarnation. For Jeremy Hunt to realise his dream is years, if not decades, in the making. His five weeks left in office won't cut it.

Jeremy

27/05/2024