Meanwhile, on Planet Japan, in Another Universe …

Risk in the East

The banking crisis has re-visited the US again, with First Republic Bank’s share price now down 90% YTD. As the long and variable lags to Fed policy impact, it is impossible to know which body will float to the surface next. However, I am surprised that Japan is attracting so little attention.

Lost in Translation

From a Western lens, Japan is an enigma. Visiting is the closest most of us will experience leaving planet Earth. Nothing is familiar, including its monetary policy. Since 2016, when the Bank of Japan first introduced explicit yield curve control, Western markets have experienced two rate-tightening cycles. The most recent represents the fastest rate increase in a generation. However, under the supervision of Governor Kuroda, Japan has kept its policy rates at or below zero.

Not Long Ago

In the late 1980s, Japan’s stock market accounted for 60% of the world’s total. (Today, the figure is 6%). It led the world in cars, semiconductors, consumer electronics, and banking. The real estate value of the Imperial Palace in Tokyo was greater than that of California.

QE Origins

Over the last 30 years, Japan’s GDP has barely changed, its stock market remains c30% below its all-time high, and its currency has lost half its dollar value. And based on current ageing trends, Japan’s population will be extinct in 300 years. Unsurprisingly, Japan has a deflation problem. In the early 2000s, as an essential strand of Abenomics, The BoJ introduced the novel monetary policy of Quantitative Easing to try and create inflation.

Failed Reflation

In Japan, free money is baked into everyday life, reinforced by the exceptional tenure of its architect-in-chief, Kuroda. But despite its two-decade QE policy, Japan’s inflation rate has remained low. Having averaged zero for 20 years, the Bank of Tokyo’s policy rate is currently -0.1%. But recently, life on Earth has impacted planet Japan and its CPI rose above 4% for the first time since 1980.

Careful What You Wish For

Earlier this month, Kuroda handed over the reins of the BoJ to the unknown academic Kazuo Ueda. In the period Koruda has been in office, Japan’s national debt as a percentage of GDP has grown from c100% to c250%. (The US is 129%, the UK is 97%, and Italy is only 145%). According to Tokyo-based market commentator Weston Nakamura, more than 25% of Japan’s government spending goes on debt servicing, meaning Japan would be insolvent if its new central bank governor normalised interest rates. However, in Japan, there is a tendency for procedures to lead people, which is the other reason why Mr Ueda will retain QE and yield curve control policies for as long as possible. For all its problems, Japan remains the world’s third-largest economy and bond market. But its ability to remain the world’s duration anchor is increasingly hard to maintain. As Mohamed El-Erian posted recently, “the longer this policy regime is in place, the deeper the structural damage to the bond market there, and the greater the risk of financial instability down the road.”

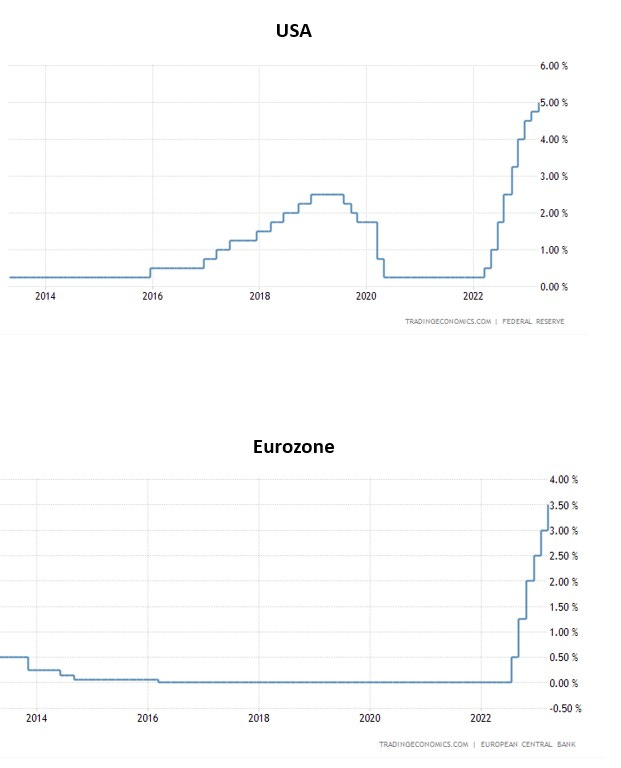

Spot the Odd One Out

Below are the last ten years of policy rates for the US, Eurozone, UK and Japan.

The post Meanwhile, on Planet Japan, in Another Universe … appeared first on Progressive.