Doping, Wirecard, HyperNormality and Gold

I just listened to an account of the Russian husband wife whistle blowers, Vitally and Yuliya Stepanov who are currently living in hiding in the US, by the Times journalist David Walsh, the man who helped uncover the deception of Lance Armstrong. It is an amazing story of people who are prepared to do the right thing, not the easy thing, and suffer the consequences. It has all the ingredients of a Greek or Shakespearean tragedy, that led to them exposing the systemic doping fraud perpetuated by the Russian athletics federation as also documented in the 2017 Netflix film Icarus.

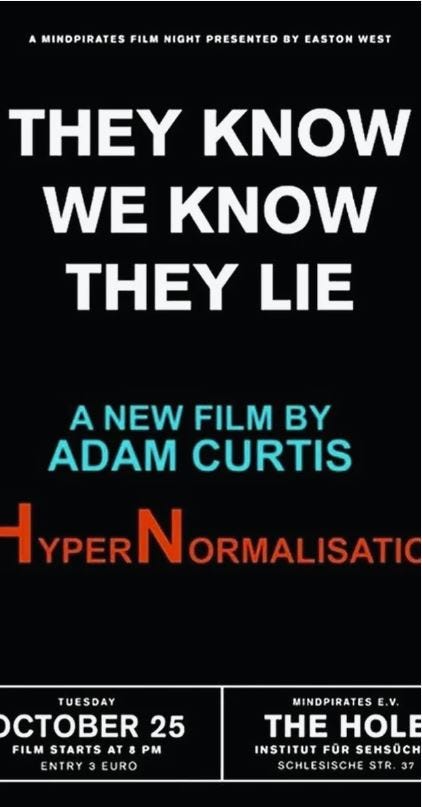

The tale reminds me of the currently unravelling of the Wirecard fraud and the attempts made by the establishment to protect it over a number of years, and pursue it detractors. Both are examples of regulatory capture, and share the same underlying pretence that the world is one thing, while simultaneously knowing it not to be. This is what Adam Curtis portrayed as HyperNormalisation in his excellent film of the same name, and the the more one considers it, the more of it becomes noticeable.

As the saying goes, very often the best fraud is conducted in plain sight. The role of the German regulator in the Wirecard scandal is no different to that of the Russian anti-doping regulator in the Russian doping scandal. As Bloomberg columnist Matt Levine noted: Companies that are not doing fraud, when reporters ask if they have faked their revenue, respond by explaining where their revenue comes from. Companies that are doing fraud, when reporters ask if they have faked their revenue, call the police to try to get reporters arrested. In the case of Wirecard it was BaFin who did Wirecard’s bidding, banning short selling speculators from undermining the German “success story” and pursuing a criminal charges against FT reporter Dan McCrum (among others).

Vested interest, and the human tendency to want to believe an untruth (known or unknown) to be true, are very real and prevalent forces, that I believe we should guard ourselves against. I would argue that this includes today the idea that the World’s Central Banks are independent of their governments and that the bond “markets” they dominate (control) are in fact, markets at all. COVID19 and the unprecedented policy response it has spawned has taken this pretence to new heights, forcing all the established actors leave unsaid what they either know, or fear, might be true. Say it slowly and calmly, governments are issuing lots of bonds with one hand and buying them back with the other. This is not a market operation, this is a deliberate attempt to deceive people into thinking they are better off that they really are, and therefore behave in ways that will help the economy recover and enable them to collect more taxes and attempt to repay its debt.

So why disturb this plan? After all if it works and it saves jobs, the economy etc. why not? They are only trying to do what is best for all of us in very difficult circumstances. This is a fair point, and it is conceivable that it might work, after all, version 1.0 was widely believed to be working post the financial and Euro crises from a decade ago. Politicians need a plan, and as plans go, it is not ridiculous, just as Wirecard’s portrayal of what is was doing was not totally incredible. However, at its core it is a fraud, and for it to succeed, just like the Russian plan to dominate Olympic sport, it needs everyone to play a part in the knowledge that it is not what it appears, it is HyperNormal. Some people knowing it, others just hoping it isn’t what they fear, but either way are not prepared to openly question it.

I have recently bought gold and a few Bitcoin as an insurance against the increasing tendency to HyperNormality in our financial markets and the consequential risk of higher inflation. Now with the gold price approaching its all time high, I am kicking myself for not having bought more.

The post Doping, Wirecard, HyperNormality and Gold appeared first on Progressive.