The old adage says that it's better to be lucky than good. Apparently, having the right network is better than both. JD Vance

Try as I might, I cannot escape my current absorption in US politics. Any desire to return to the fundamentals of the economy and its financial markets has been overwhelmed. I feel drawn like a moth to a flame or, perhaps more aptly, a blue bottle to a rotting carcass. However strong-willed, I am like all the other drivers slowing in front; I glance sideways to peek at the crash on the other side. Everyone else is slowing down to take a look. So must I.

Harold Macmillan, who steered Britain into acceptance of its reduced global role in the postwar years, was asked what were the main things that defined a statesman. He replied, events, dear boy, events. It remains a matter of dispute as to what particular events he was referring to. Was it the Cuban Missile Crisis, the Profumo Affair, the assassination of JFK or the humiliation of DeGaulle's stern "non" to Britain's request to join the European Economic Community? We will never know. But, the enduring lesson of Macmillan's aphorism is that events determine ideology, not vice versa.

The extraordinary recent events in US politics will shape a new ideological framework already evident elsewhere. Just as a grocer's daughter from Lincolnshire discovered the works of FA Hayek and a B-movie actor from California, the works of Milton Friedman to justify actions taken in response to the events challenging their countries in the 1980s, so too are Viktor Orban, Georgia Meloni and the MAGA 2.0 movement seeking to share and shape the ideas of a new economic nationalism. The car crash we are observing is the boomer legacy of postwar consensus.

Last Sunday, in Butler, Pa., former President Trump came within a centimetre of having his brains blown out. Suddenly, a radical new version of the West's future emerged. A future from which many have been demanding protection while others have assumed an ordained role to protect. This protection now looks as fit for purpose as provided to the former President at Butler.

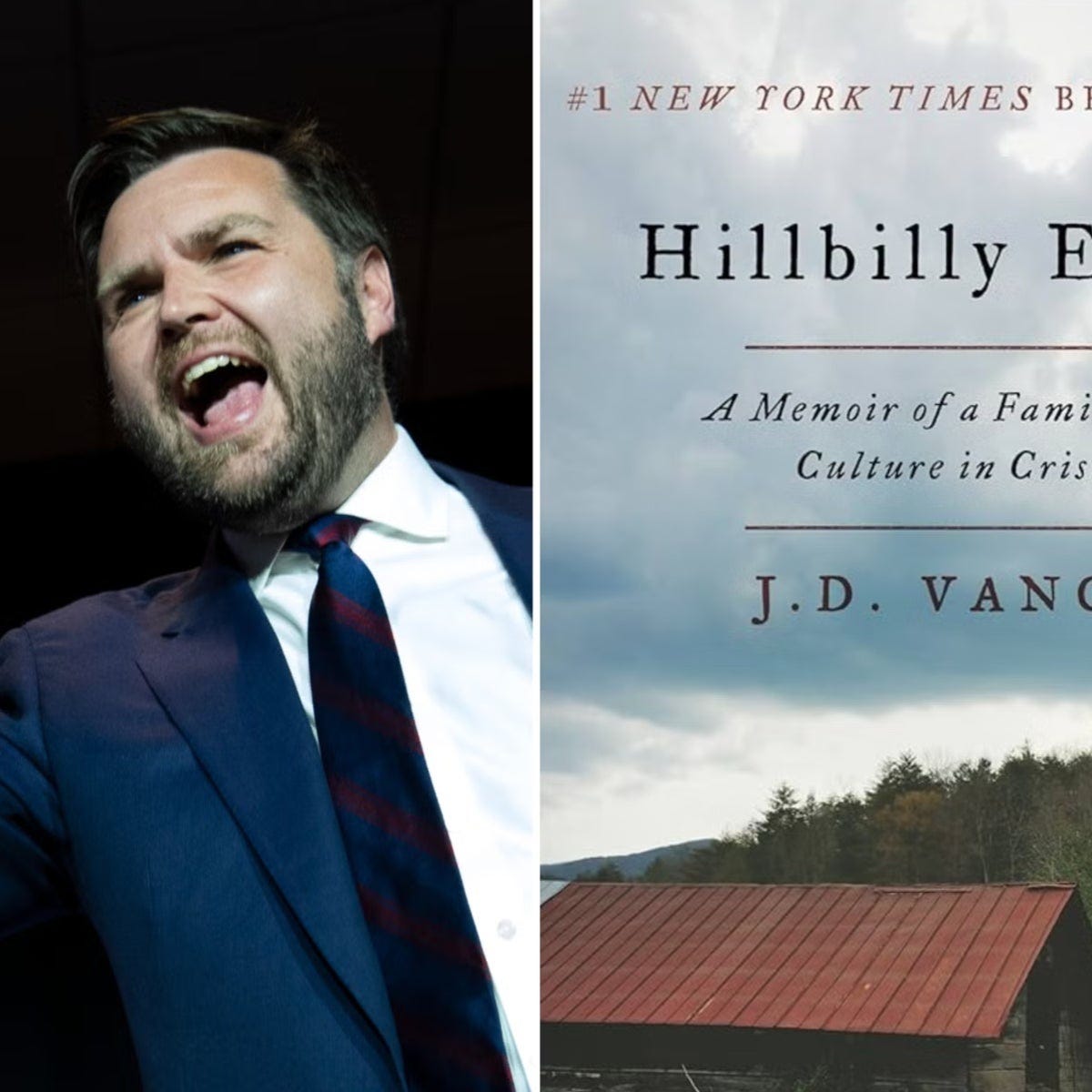

A few days later, burnished with a bullet-proof sense of destiny, Trump chose the relatively unknown JD Vance as his running mate in Milwaukee. A man half his age, Vance has packed a lot into his adult years and is now the favourite to be POTUS from 2029. MAGA is back, and this time it's serious. It can now self-replicate, and JD Vance is its next evolutionary branch.

Vance is very different from an appointee like Mike Pence, who was able to secure a constituency with which Trump struggled. Vance is as MAGA as Trump, probably more so, and he comes with the prospect of cementing the Republican Party with an ideology. A Hillbilly Elegy for our times.

Vance is everything Trump isn't. He was born poor, served his country, attended an Ivy League law school, and authored his own book. But critically, his political ideology has been shaped by the events of the 21st Century, which, as Niall Ferguson pointed out in We're All Soviets Now, sharply contrasts with Trump and Biden, both born in the 1940s and the postwar consensus and its institutions.

Vance was seventeen at the time of 9/11 and served in the US Marine Corps from 2003 to 2007, spending six months in Iraq. As the world went through the Global Financial Crisis and its aftermath, Vance attended Ohio State University and Yale Law School. He spent two years climbing the corporate law ladder when a chance encounter with venture capitalist Peter Thiel led him to Silicon Valley in 2016. Vance had a ringside seat as the 21st Century's Masters of the Universe strode their territory in full force.

Trump and Biden represent the end of the boomer era, the postwar generation driven by market economics and the export of liberal democracy abroad, if necessary by force. This ideology won and then self-replicated after the collapse of the Soviet Union, permitting the enduring fallacy that the US military will always prevail as the world's police force.

However, this boomer version of liberalism allowed itself to become corrupted by its conceit, paternal arrogance, and self-replicating elite overproduction. Many saw it as an ideology that allowed the reprisal of an angry Russia and allowed China to create the Rust Belt of Vance's upbringing, the destroyer of the white working-class family, including his.

Vance is a Republican Party Reptile unrecognisable to PJ O'Rourke. There is no Reaganomics or Neo-Con foreign policy. These people are prepared to trade economic growth and the vested interests of big business for domestic manufacturing jobs. Vance is more pro-Union than pro-big business; he is a fan of Lena Khan, a British-born Yale Law School contemporary who was the youngest ever Chair of the Federal Trade Commission and a Biden appointee. Vance is also a law school contemporary and friend of Vivek Ramaswamy, who many think Trump might have preferred to Vance if it wasn't for his difficult-to-pronounce surname and superior oratory skills.

Vance, Khan, and Ramaswamy represent reactionary ideas from the events of their formative years, and the impact of technology on the internet generation is critical. Vance's introduction to Silicon Valley via his mentor Peter Thiel opened all the crucial doors. Ultimately, this led to his backing from Donald Trump and some of the Valley's wealthiest political donors, including Thiel's PayPal friends Elon Musk and David Sacks. The VCs and entrepreneurs who have followed with their money (such as Marc Andreessen and Ben Horowitz) represent the anti-Google and Microsoft wing of the Valley's glitterati. These are the ones who resent Big Tech for stifling the budding unicorns such angels have anointed.

Of course, we have yet to have the election, and we have yet to know who Trump and Vance will face in November. There is time for Trump to shoot himself in the foot, so to speak. There is also time for Vance and Trump to fall out and for MAGA 2.0 to end in chaos and recrimination.

But for now, another legacy political leader looks likely to exit stage left, and the Democrats look likely to face a period of regrouping and repositioning in reaction to a new brand of populist Republicanism.

So what of this future? What is the Trump Trade? And how should investors position themselves if and when this new ideology emerges?

Some critical elements to consider include (please add others in the comments below):

Defence

Trump will not pull the US out of NATO, but his warning to Europe about funding its defence has been clear, and this time, he means it. European defence spending must increase and will be disproportionately spent in Europe.

Energy

During Biden's term, the US became the world's largest oil and gas producer. Its production increase since 2005 is twice Saudi Arabia's annual production. Trump will proudly urge the shale men to drill, baby, drill. If he can negotiate peace in Europe and the Middle East, the cost of energy will plummet, reducing inflationary pressure, particularly in Japan and Europe. Although opening up the Gulf of Mexico to more LNG export facilities would benefit domestic US natural gas prices.

Trade Policy

Trump has talked the talk about America's Rust Belt, but Vance will walk the walk. The blame lies with the boomers allowing China into the WTO in 2001, creating an opioid-addicted underclass. The response will be tariffs and a lower dollar.

Fiscal Policy

The era of fiscal dominance, characterised by the Inflation Reduction Act and the Chips Act, will continue. Federal spending will be less focused on fabs for Intel and TSMC and more widely spread among such things as open-source AI apps to train skilled workers.

Monetary Policy

Trump has threatened to remove Jay Powell, the man he appointed to run the Federal Reserve, but this is unlikely. He will, however, apply pressure for lower policy rates, steepening the yield curve and continuing the equity trend away from growth to value and smaller-cap stocks. This will also raise dollar debasement fears, fuelling further rises in real assets and precious metals prices.

The Dollar

An increasing proportion of Trump's advisors see a weaker dollar as a policy goal. Any success in this policy represents a risk and an opportunity. A lower dollar is deflationary for everyone outside the US to the extent that they pay for their imports or have their debts denominated in dollars. It also creates problems for anyone competing directly with US-manufactured products.

UK Economy & Markets

Lower energy prices and a lower dollar would benefit the UK economy. A weaker dollar policy would disperse US capital into overseas markets. As a matter of some urgency, the UK will need to decide whether it is with the US or China on trade. Europe has followed the US in applying sanctions on Chinese EVs, and the UK's move will be crucial.

Bitcoin and AI

If you think Vance was a late MAGA convert, consider Larry Fink's and Jamie Dimon's datelines for their Bitcoin adoptions. With both mentioned as contenders for Trump's Treasury Secretary post, Bitcoin's place in the US financial system seems assured. Regarding AI and tech policy, look no further than Elon Musk and his opposition to Apple, Google, and Open AI. Open source AI with an emphasis on free speech, and what about the reversal of Elon's X into Trump's Truth Social to show the legacy media elites their time is up?