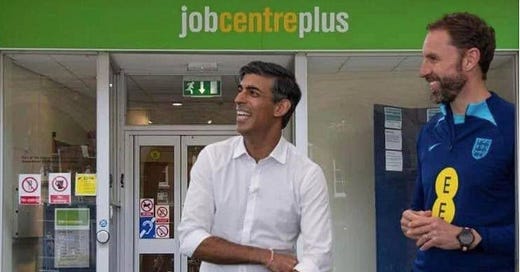

Following the UK economy over the last couple of years has been like following the England football team's journey to the knockout stages of Euro '24. Having played a safety-first, sluggish game since Q4 2022, outperforming sceptical expert expectations, the UK economy remains in the game and can still reach the top. Although such an unexpected outcome would require more recently successful competitors to fall by the wayside, it is said that defence wins tournaments.

It is halftime in the year of elections, and the UK's position is not deteriorating. Since the painful days under previous (mis)management, the UK's defensive style has been uninspiring but effective. The UK's imminent new management might only involve a change of strip and a new team talk, while the rest of the world has started looking increasingly uncertain and rudderless. It is all still to play for.

Let's have a look at some halftime stats and the outlook for the second half.

The world economy has continued to grow, led by a fiscally supercharged US that has overcome sluggishness in China, the Eurozone, and the UK, but its growth rate is slowing. The UK's position looks better when looking at economic momentum or the rate of change in GDP growth. The UK's Q1 measure was revised up (again) to 0.7%, compared with 0.3% in the Eurozone and 1.3% in the US. US GDP growth has slowed rapidly from 4.9% to 3.6% in Q3 and Q4 last year. Even China only managed 1.6% in Q1 despite massive stimulus packages designed to lessen the impact of a troubled real estate sector. The UK could yet outperform a slowing world economy.

Inflation continues to fall everywhere, and although there are warning signs of a second wave, it is when and not if targets are hit. The UK was the first to achieve the 2% target in this cycle. However, the UK and the Eurozone have suffered larger aggregate inflation than the US, primarily reflecting differing energy policies. Energy prices remain critical.

The global rate-cutting cycle arrived later than the Federal Reserve led markets to hope a year ago. It is now underway, with Canada and the ECB in the vanguard. The UK will join the party next month, while the Fed will in September or November, complicated by Biden's faltering presidential election campaign.

Along the curve, 10-year bond yields rose in all major markets, with recent idiosyncratic spikes in Japan and France causing concerns in the Euro and Yen markets, but so far, with limited broader impacts. Meanwhile, the UK's Truss Sterling/Gilt blow-up two years ago is fading from view.

The UK's net debt to GDP ratio is well positioned among G7 countries all facing the same basic fiscal problem. However, as Simon French of Panmure Liberum points out, with 25% of its debt issued as index-linkers, the incoming government has more room to manoeuvre than most others.

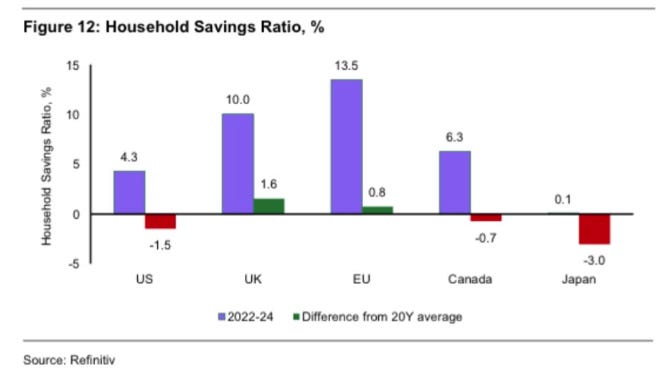

The UK consumer has spent fifteen years rebuilding overly indebted balance sheets pre-GFC. The post-COVID inflation shock and rising interest rates provided further bumps in the road. But with inflation on target and rates likely to fall, wage growth trending above CPI, and solid employment conditions, consumer confidence looks to be through the worst. While there remains reticence regarding large ticket item discretionary spend, everyday consumption patterns continue to trend up.

The Pound (GBP) has been the most stable major currency relative to a strengthening US dollar (USD) YTD. With a very weak Yen cancelling out dollar-based Japanese stock market gains, the UK looks well placed as the lowest-value risk-adjusted developed-world stock market.

The oil price (Brent) has traded between $76 and $90, and its recent move up from the lower end of that range seems more to do with geopolitical concerns than economic recovery. With its renowned PhD in economic forecasting, the copper price supports this view; it peaked at +30% YTD in May but ended the period sharply declining, albeit still +13% over H1.

Meanwhile, the gold price has continued to outperform a strengthening USD, defying the lure of "higher for longer" rates. It finished H1 only 4% below its all-time high set in May and +15% YTD. Geopolitical instability and EM central bank accumulation have been the key features, and if H2 sees lower-than-expected rates and sticky inflation, then new all-time highs could follow.

As the world fractures, deglobalises, and re-shores, higher base-level inflation is likely, all other things being equal. Bond investors will be vigilant to signs of inflation targets slipping from the accepted 2%. A tacit acknowledgement of a target at 2.5% or higher could see a return of the bond market vigilantes. Again, the UK’s post-Truss safety-first approach offers more protection than most.

AI could change our inflation assumptions. The question is, which way? On the positive front, breakthroughs such as fully autonomous vehicles and hyper-intelligent digital assistants would be deflationary. However, AI's insatiable power appetite risks creating inflationary energy price spikes with fragile power grids and under-investment in primary energy sources.

But, whatever its future path, AI remains the North Star for global equity investors, and Nvidia is their focal point. Its share price is up 150% YTD and 35% in Q2. It is now the third-largest company in the world and has helped NASDAQ and the S&P indices continue outperforming, posting +21% and +15%, respectively, in H1. Concentration remains a critical characteristic of equity markets, and the timing of any unwind remains uncertain.

Despite still trailing behind the US market, UK indices all posted mid- to high-single-digit gains, with the broadly based FTSE-All Share index up +8% YTD and +2% in Q2. The AIM All Share index, the 700-strong index of small and mid-cap companies on London's junior market, was broadly flat over H1, having been +6% by the end of May. This index has now flatlined for the last 12 months, falling a cumulative 35% over the two years up to June last year. It is hardly a bull market, but a base has been formed upon which progress can be made.

Allenby Capital's analysis for the year to the end of May shows that while the number of AIM companies continues to decline, nearly half of those leaving were acquired at an average bid premium of 48% to the prior close. Meanwhile, AIM liquidity has continued to improve, with May seeing the highest percentage of market value traded since June 2021. The number of new company joiners and the amount of capital raised are moving up, too, albeit from very subdued levels. The successful IPO of Raspberry Pi on the main LSE market should stimulate renewed interest in smaller company IPOs over the coming period.

Bids and share buybacks have offset net investor outflows, resulting in a flatlining market. However, anecdotal evidence suggests UK retail outflows from UK smaller company funds have stopped, or at least turned to a trickle, while new mandates from global family offices and overseas investors are appearing for the first time in years.

Fund manager AssetCo last week reported that it had won two institutional mandates into specialist UK equity strategies, totalling £120m since March. While small, these represent "the first such mandate wins for a considerable period" and, according to AssetCo, are due to "a more positive attitude towards the UK equities market generally."

Dowgate's Onward Opportunities closed-end specialist microcap investment vehicle increased its capital base by 15% this week, raising just over £3m at a premium to NAV. Such a deal is virtually unprecedented in the UK-listed fund sector, which typically trades on double-digit average NAV discounts. The Onward appeal rests on strong performance since launch, a specialist focus on illiquid assets with desirable value characteristics, and dwindling institutional knowledge of this forgotten area of the UK market. To issue equity at a premium indicates that demand exceeds supply.

As the headline in the Times today noted: Suddenly Britain seems like the sensible one.

Unlike the England football team against Switzerland, the UK economy and its stock market are not in knockout competitions. But they have been seeded below their long-term potential for too long. The UK's continued steady performances deserve reappraisal among the seasoned and sceptical match-day commentators, suggesting a multiyear opportunity for the UK to outperform an insecure and chaotic world.

It is all still to play for.